A colleague recently shared with me Benedict Evans’ tech trends for 2023 presentation. It’s amazing — 104 slides of compelling data that make sense of a dizzying range of topics, from interest rates to consumer behavior to global power-shifts to a new breed of digital gatekeepers. Before proceeding, I have two admissions to make: (1) I was previously somehow unfamiliar with Evans’ work; but I will pay closer attention going forward. (2) Although macro tech-trends conceptually interest me, I sometimes find it difficult to connect them back to our seemingly more pedestrian work of building small-scale B2B SaaS businesses. With these confessions in mind, this blog post is for practitioners like me. It cherry-picks just a few of the presentation’s many awesome slides and highlights points that struck me as particularly relevant to SaaS operators. It does not attempt or purport to summarize the presentation; and it’s certainly not comprehensive. Rather, it’s just a quick-share of my top takeaways — a codification of those points that I plan to revisit and bear in mind in the day-to-day fray throughout 2023. And they are…

Is it now time for the little players to have their day from an employment perspective? It was difficult during the pandemic for small-scale SaaS businesses to hire / retain top talent. To use a basketball term, the “possession arrow” in the resource economy seems to have shifted from employees back to employers. More specifically, with a quarter million veterans of big tech firms newly unemployed, what kind of a recruiting opportunity does this present for us? What roles could these people fill in our businesses, how best to recruit / on-board them, what support might they need to make the transition to small companies and to thrive in a less structured environment? This feels like a great, but fleeting, opportunity, let’s make the most of it.

2. Glass half empty, glass half-full (Slide 16):

This slide reminded me of an oft-cited pearl from the best software investor I know, “when it’s going well, things are never as good as they seem; and it’s never as bad as it seems when they’re not.” As a SaaS investor-operator, I found this slide encouraging. Particularly the last bullet: every market, every value-chain, every workflow, every customer engagement, every dataset is being rethought and remade — and there is still a ton of work to do on this front. When it can sometimes feel like every industry has already gone through digital transformation, this is an important point to remember. The following slide (about enterprise workloads in the public cloud) struck me as using different data to reinforce this same point.

3. Fragmentation (Slide 49):

This slide specifically addresses the steadily declining share of Nielsen ratings among the top-rated US TV shows over numerous decades. So, what does this have to do with small-scale B2B SaaS? What it highlights for me is that today’s most successful, top-performing shows only draw 10% of the available viewership. And they’re still winners. Perhaps not to the same degree as I Love Lucy back in 1955, but still massively successful. There are many niches, within which B2B SaaS businesses can thrive. And while they may need to garner more than 10% market share if they operate within a particularly small vertical, they don’t need to be all things to all people in order to prosper. If “focus is the friend” of SaaS operators, this is good news.

4. The ‘innovators’ dilemma costs real money… (Slide 55)

It’s hard to argue against being fist to market. But being the challenger does have advantages, and a lack of legacy baggage is one of them. This slide hammered home for me what small-scale SaaS operators inherently feel: it’s often more efficient / liberating / plain-old-fun to go-to-market as an innovative fast-follower than as the incumbent with tons to lose. Small-scale SaaS business should embrace that mentality and its many benefits.

5. Advertising is the price you pay… (Slide 69)

I’d never heard this fascinating 2009 quote from Jeff Bezos. And, although Evans goes on to illustrate that Amazon has since become the world’s largest advertiser, it’s a great reminder to budget-conscious SaaS operators.

In short, it puts a premium on ALWAYS focusing on ensuring that a business’ products are differentiated from those of competitors. Moreover, this highlights what is true in many vertical SaaS markets — that there are other, more effective means of communicating one’s go-to-market message (e.g. thought leadership content, earned media, word of mouth, customer references, community marketing, conferences, etc.). Said another way, should direct their energy into scalable and high-return organic marketing initiatives, rather than costly PPC efforts (aka advertising). Focus there.

6. The end of the American internet (Slide 95)

The “focus is your friend” axiom has a downside; and that is that it can foster short-sightedness. I found this slide to be a good reminder that even small-scale businesses should always be scanning the horizon to grow TAM and identify new opportunities to win customers. Wow, this slide is a mindblower — although the US may continue for some time to be the largest single market for B2B SaaS, other markets demand serious consideration.

I have no big finish to this post. Rather just a big thank you to Ben Evans for his fantastic work. It really is helpful, not just to the large players on which much of his work focuses…but also to small-scale operators who can learn from the trends he highlights.

As I’ve written previously, I’m not a fan of the term “playbook,” despite it being a metaphor that is used with reverence in many private equity circles. In my view, the reality facing small-scale SaaS businesses is too complex for 1-size-fits-all playbooks to be universally valuable. But I have also observed that a set of core disciplines consistently catalyzes the sustainable growth of capital-efficient SaaS businesses; and we regularly leverage several frameworks to reinforce these concepts. I was recently made aware that my enthusiasm for such frameworks or mental models had turned me into the proverbial “hammer,” to which everything looks like a “nail.” At the time, I was in a discussion with one of our portfolio company CEOs about a particularly thorny issue they were facing. As I unhelpfully tried to solve the issue with 2x2 matrices, “pattern recognition” drawn from other businesses, and a wealth of publicly available SaaS benchmarks, the business leader kindly said to me, “Hey…you know…not everything is a F8*%^&! framework.” Boom — direct hit.

This simple reminder got me thinking about situations in which a framework or mental model (or a playbook(!)) really are NOT helpful to operators of SaaS businesses. I’ve shared a few of these below. My hope in doing so is that it helps leaders of small-scale SaaS businesses to distinguish between the many situations when a pre-established framework / approach can be extremely helpful…versus those critical instances when a totally unscripted response is not only warranted…it is needed.

Hard Things: In his epic work The Hard Thing about Hard Things, Ben Horowitz argues that building a software business reveals countless problems for which there just aren’t any easy answers for leaders. Those include firing friends, poaching competitors, and knowing when to call it quits (among many others). These are very real, very important, very “anti-framework” type problems. Sometimes things are just…hard. In those situations, it’s important for leaders to stay true to their values, safeguard the company’s vision / mission, and…just keep moving forward. Particularly in situations with no seemingly pleasant options, overly analytical mental models rarely help. Instead, they can delay the inevitable and prolong the agony for all involved. Better for leaders to pull their socks up, and just get on with it.

Art & Science: Some aspects of SaaS businesses are clearly more science than art (examples include financial bookkeeping, constructing entrance / exit criteria for sales stages, and collecting statistically valid NPS data from customers). Still, others are a blend of art and science. For example, we can use a carefully researched product framework to help empathize with, and prioritize input from, customers (science). But it’s a far more artful endeavor to incorporate that input into a brand that faithfully captures the essence and a resonant market-promise that we want to non-verbally convey to all stakeholders. Art doesn’t need a framework; art needs to touch-off the right note in people’s System 1 brains. Note of disclosure: We admittedly do use a number of frameworks to assist in a carefully considered re-branding process. But at a certain point, it’s all about the output and not at all about the process imbued through framework-type thinking.

Unique Problems: It’s been written that “there is nothing new under the sun.” And while I won’t debate this point on a fundamental level, there are exceptions in small-scale SaaS businesses. Although there are a finite number of moving parts in SaaS businesses, fact-patterns often arise for companies, where they are facing challenges that present themselves in completely new and unique ways. For these situations, frameworks are relatively helpful; rather creativity is required. I’m reminded of a platform-upgrade and related migration challenge that we experienced at one SaaS business. The SaaS world has seen countless upgrades / migrations, so we looked to past precedent and roadmaps to inform the initiative. But the specific combination of business context / use-case idiosyncrasies / uptime requirements / seasonality of our customers demanded that we establish a completely unprecedented approach to the migration. A mixture of creativity and ruthless pragmatism carried the day; frameworks were unhelpful.

Make to Scrap: Software is all about efficiency, and we SaaS leaders hate re-creating the wheel. With this in mind, we err toward thoughtfully building our products and processes with attention to ensuring scalability and re-usability. But some situations demand speedy action for a pressing moment, with little thought to future needs. This might mean spinning up a (true) MVP, filling an urgent personnel need with outside resources, or addressing a surprise market condition with a one-time targeted offering. In any of these cases, one-time-only action may trump frameworks.

In closing, and to be clear, mental models greatly assist SaaS operators in countless situations. But it’s also important for SaaS leaders to leave room in their brain to recognize those less frequent situations when frameworks are less helpful, possibly even counter-productive. Where fortitude, creativity, speed, and situational decisiveness are what’s needed most…not everything needs to be a F8*%^&! framework.

A recent post on this blog identified different types of client feedback groups that small-scale B2B SaaS businesses can set-up to intentionally solicit input about their market and solutions. That post went on to assert that managing such groups can be difficult and costly in terms of time, resources, and money. In retrospect, that was probably only partially helpful. This piece aims to improve and expand upon the last one by offering (a) a case for why programmatic client engagement is well worth the investment and (b) a few tips for avoiding some of the (many) mistakes that we’ve made on this front over the years.

It’s Expensive // Is it Worth It?

Yes, it really is. There are countless ways that such groups can benefit SaaS businesses; we’ve coalesced around 5 big ones that we hope to get out of such initiatives.

Avoiding the Pitfalls:

Hopefully the case is clear for why client engagement groups are well worth the effort. So, now for a few words to the wise in terms of do’s and don’ts for managing them:

Hopefully this follow-up post offers a valuable expansion upon its predecessor. In sum, investing in customer engagement is well worth the effort. But, as in all things, a bit of forethought and awareness of pitfalls should make that endeavor more rewarding with less risk.

One-size-fits-all seems to work fine for a few things. These arguably include: plastic rain ponchos, ping-pong paddles, the Flexfit ball caps that my dad likes to wear, and those awful grippy-socks handed out on trans-oceanic flights. For everything else, though, one-size-fits-all is brutal — always sub-optimal, often ineffective, and sometimes flat-out painful.

This principle holds true in many aspects of the small-scale SaaS world. And yet, we SaaS leaders consistently fall into the one-size-fits-all trap when it comes to customer engagement and setting up a formalized channel for soliciting actionable client feedback. There are many reasons for this including the fact that early-stage SaaS businesses often entirely lack an intentional approach to collecting market feedback; and launching an inaugural customer advisory board (often referred to by such acronyms as CAB, PAB, SAB, PUG, BUG, etc.) legitimately represents a major leap forward. Really, it does. Still, a one-size-fits-all approach to customer engagement can sometimes create as many problems as it solves. To describe and to combat that, this post draws on observations across many years & multiple companies to offer a framework for thoughtfully selecting an approach to customer engagement that best suits a business’ specific needs.

First, let’s introduce a few terms that will be useful to any discussion about programs for soliciting customer feedback:

· Focus groups / 1-on-1 Interviews: When conducting a focus group, researchers gather a group of clients / customers / users together to discuss a specific topic (or they do it on a 1-on-1 basis). Usually, the goal is to learn people’s opinions about a product or service, not to test how they use it. On this point, let’s draw a distinction here:

· Surveys: Standardized data collection from clients / users on a defined market or particular product.

· Tools / Data: Methods for gathering broader insights, including product usage stats, industry data, heat maps, A/B testing, etc.

· Client Groups: Convening knowledgeable clients who provide insight on the market and feedback about your solutions via the methods described above.

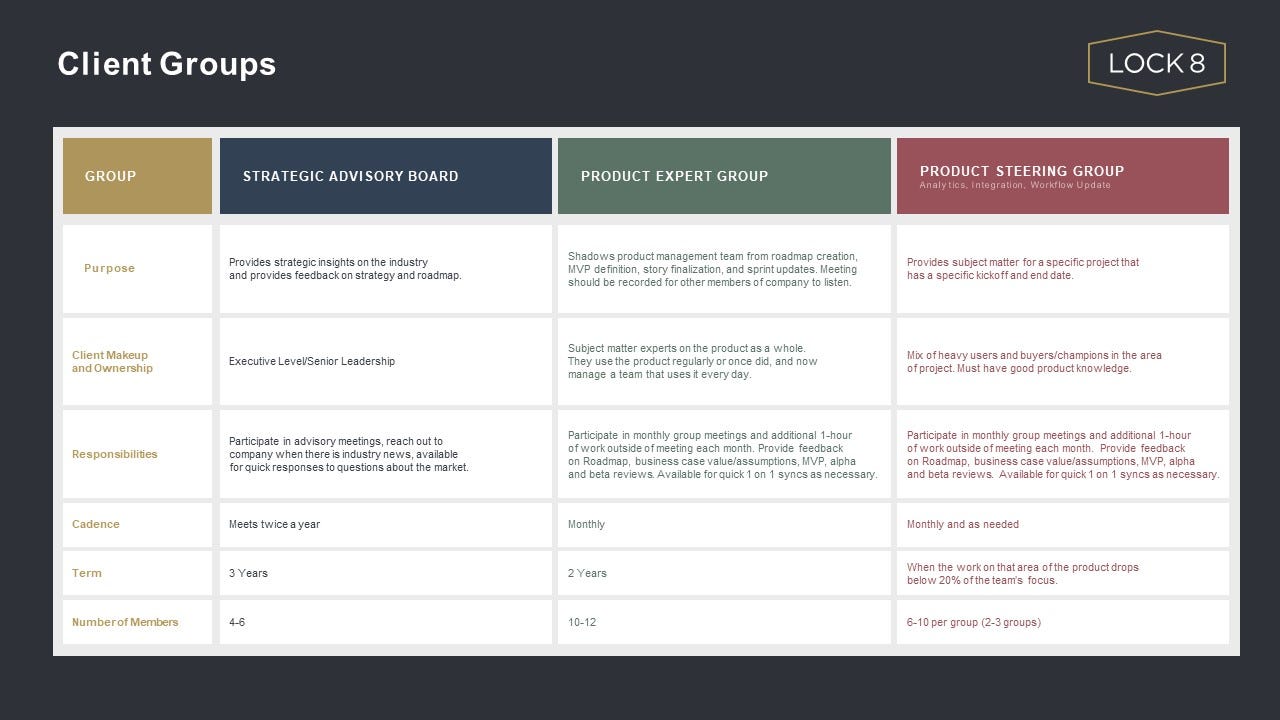

To be clear, all of these can be valuable, but this post focuses on the last of these forms of engagement — client groups. While there are arguably countless different flavors of client groups, we’ve observed three general types, as follows:

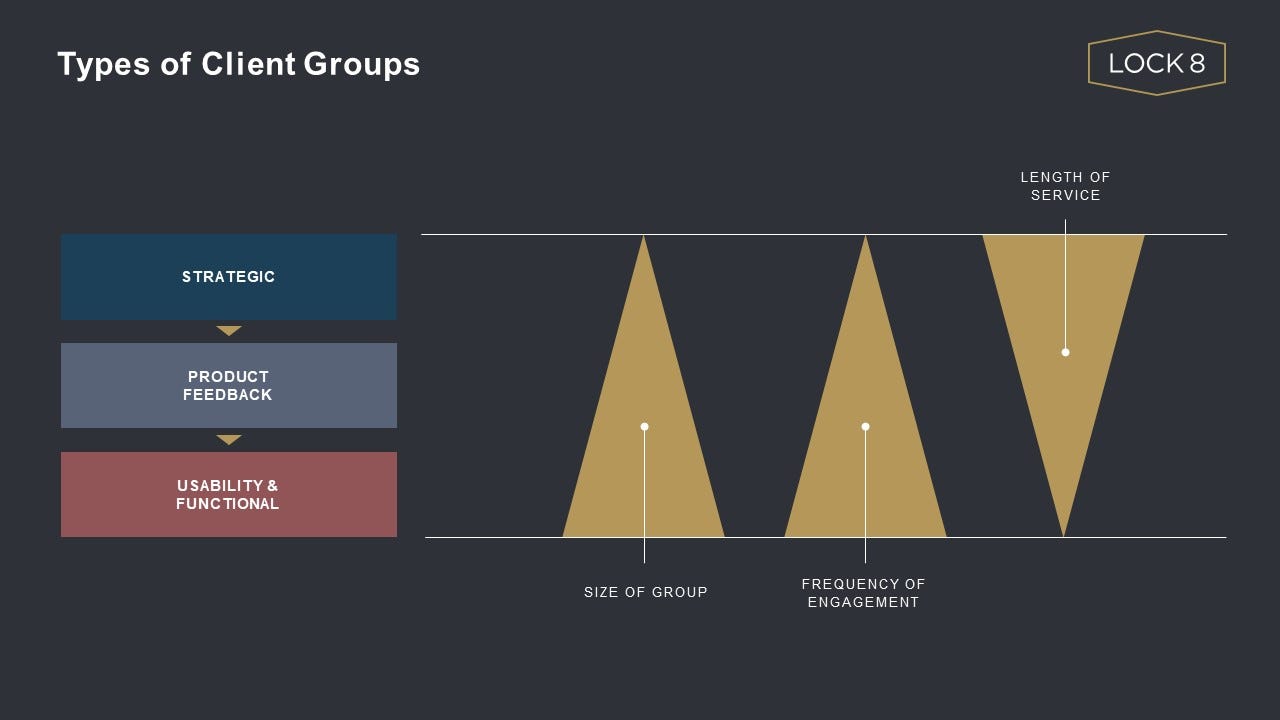

Hopefully these brief descriptions make a clear case for how each of these groups would serve vastly different purposes on behalf of a business. The graphic below double-clicks further into how these groups typically differ in terms of size, meeting frequency, and longevity of commitment.

To summarize:

The table below adds some quantifiable detail around how we tend to think about and structure programs for each of these types of groups.

To go one step further, and for those so inclined, it is also worth expanding upon this table as your programs become more formalized. We tend to add the following rows to nail-down additional criteria, including:

In closing, a few words about why these distinctions actually matter: Most importantly, small-scale SaaS businesses have a finite set of resources; and engaging with these groups is hard(!). We think about the challenges of managing user groups in two categories, as follows:

I. Time & Resources — it takes a lot of both; below is a set of related tasks:

II. Mixed Results — the hard reality is that these forums don’t always yield the expected outputs; below is just a small sampling of ways these groups can run off the rails:

As a SaaS business evolves its programs for engaging with customers, it would be ideal to simultaneously manage a portfolio with one (or more) of each of these user groups. Sadly, (to repeat) small-scale SaaS businesses constantly balance the tension between an infinite set of possibilities against tightly constrained resources. Given that, it’s important that they ruthlessly prioritize in all areas, including how to programmatically solicit strategic / product feedback from their clients. So…with many small-scale SaaS businesses looking first to mature to the point of having even just ONE of the customer feedback groups described above, it’s important to do so with intentionality. Because, as with most things, one size does NOT fit all…avoid the plastic poncho; and choose wisely.

A word of thanks to Paul Miller, ardent product management leader, now CEO, and previous thought partner to this blog, who recently helped me to crystallize “what good looks like” in terms of customer engagement programs.

3

The so-called Great Resignation was the topic of a previous post on this blog, and the following piece is a spin-off from that. That prior post focused on employee retention, as have so many recent articles. But we’ve experienced a separate challenge at Lock 8 that also bears discussion — how to get job candidates to actually leave their old company in order to join ours. To be clear, this isn’t a question of how to craft compelling job offers in an historically candidate-friendly market — that’s also rich topic that has been well-covered. Rather, this is about getting candidates who’ve formally accepted offers to actually follow-through on those commitments and show-up for Day 1 in their new company. Seems simple enough, but this challenge is proving to be non-trivial.

Admittedly, there is always risk associated with attractive candidates reconsidering their acceptances of offers, but we’ve seen an explosion of this practice lately. This appears to be yet another employer-focused disruption amid the broader upheaval of the Great Resignation — so much so that we’ve begun internally calling this practice the “Great Renege-ation.” This trend prompted us to consider tactics aimed at ensuring a higher “start-date” yield among accepted offers. Below are a few of the observations, lessons-learned, and things-we’ll-do-differently-next-time:

Bonus Tactic: While most of this piece focuses on closing candidates, it’s worth finishing with a downstream point about the new employee lifecycle. An element of surprise can be really helpful 6 months into someone’s tenure, such as providing an unexpected pay bump or options grant. Getting some re-enforcement that they are doing a good job and surprising them is a nice way to build stickier relationships with newer team members.

It’s a talent arms-race out there…anything we can do to get a leg-up amid the Great Resignation / Great Renege-ation is worth considering in this high-stakes game.

At our pre-wedding rehearsal dinner, one of the groomsmen made the following toast: “A person is judged by the company they keep. And, although I’m not all that crazy about Todd, his friends are truly amazing!” It was one of the best compliments I’ve ever received.

In the 20-something years since, that dynamic persists: I’ve been fortunate to meet, collaborate with, learn from, and befriend many remarkable people in and around small-scale SaaS businesses. Some of them have generously shared their wisdom on this blog (such as here and here). Today that practice continues with some sage advice from Robert Morton.

I met Robert during our shared time at Blackboard; and now the guy just can’t shake me. A true lifelong learner, Robert has continued to expand his formidable skills and push the boundaries around how to build durable businesses and relationships. He recently hung up his own shingle as a growth and customer insight / experience consultant at Highland Advisors (full disclosure, Lock 8 is a proud client). He also recently wrote passionately about the concept of consequentialism as it relates to customer experience. With Robert’s blessing, I share those thoughts below. Thank you, Robert; here’s to consequentialism:

Every time I read another company drone on about “we strive to put customers first”… only to follow with some weasel-ey, anti-customer move, I’m reminded just how badly most outfits need a dose of consequentialism. A mouthful of a word but the gist is this…

Your intent doesn’t matter, what’s in your company heart doesn’t matter… there’s just your actions and what they result in.

If the move you’re making improves customer value, it’s a customer centric move.

If the move you’re making chips away at customer value, it’s an anti-customer move.

That’s it. What you mean, or how well you wax poetic about your customer-centered beliefs, doesn’t count. In this view there are just actions and a tally of outcomes over time that add up to a more customer-centric or more anti-customer bearing as a company.

Over-simple? Maybe. Isn’t intention a mark of seriousness and care in the approach to just about anything? Perhaps.

But I’ll wager we’d have better customer outcomes, with a lot more impact per word, if we at least passed a consequentialist lens over all the customer (employee too, likely) moves we make.

No self-soothing with noble intents or rationale gymnastics allowed. Just the cold light of asking ourselves “is the outcome of this thing we’re planning customer-centric or anti-customer”? And if the latter, “how do we feel about that, what do we want to do about it”?

And if you believe as I do that the conversations you have shape the culture you have, simply posing and wrestling with these questions in the open carries its own very powerful reward.

Because when we do, we change the accepted language and conversation of our orgs. Turning more of our everyday work gabs into open development discussions about the customer (or employee) experience we want to make here.

And that, more than any single CX decision we end up making, may be the most consequential move of all.

As he does in his blog with astonishing frequency, David Cummings last week put his finger on a pervasive problem in startups: complexity of messaging. To cap-off a characteristically well-constructed case for communicating with simplicity, the post concludes with this guidance to operators: “The next time you describe your product, competitive position in the market, or value add, reduce the complexity of the verbiage. Increase the understandability. Make it clear.” Such great advice; and I’ve been thinking about it all week. But, like many things in life, it is easy in theory // difficult in practice. So, I’ve tried here to stand on the shoulders of a giant, and offer 10 tips & tricks that we’ve employed in our own efforts to follow David’s counsel toward clear messaging:

In short: David Cummings was dead-right — in terms of company messaging, make it clear! Hopefully these tips make it a bit easier to do so.

Valuations for publicly traded SaaS businesses are bananas right now. At the time of this post, Zoom’s enterprise value relative to its last twelve months of revenue (EV / LTM) was an eye-popping 58.41x. Veeva’s EV / LTM ratio was 37.02x; and “lowly” Salesforce’s was 10.03x. And it’s not just the stock market; valuations for privately owned SaaS businesses are also flying high. Against this backdrop, a colleague recently shared with me commentary from a similarly frothy time for software businesses. In mid-2011, legendary venture capitalist Bill Gurley tackled the topic of business valuations in his Above the Crowd blog with this article: “All Revenue is Not Created Equal: The Keys to the 10X Revenue Club” (5/24/11).

In this piece, Gurley makes a compelling case against the use of revenue multiples as a means for valuing businesses (“…the crudest valuation tool of them all”). But, seemingly acknowledging the ubiquity and simplicity of revenue multiples relative to his favored Discounted Cash Flow analysis, he then goes on to comprehensively explain the characteristics of high-quality revenue companies versus low-quality revenue companies. These differences, he argues, are what accounts for high valuations (10x+) for some companies, and not for many others. In some ways, the article offers a fun look-back to a seemingly quainter time (e.g. LinkedIn had just gone public that week in 2011, and analysts were skeptically scrutinizing its implied multiple of 11.8x — 15x forward revenues). But it is also a timeless study, with many insights that remain applicable today. With that in mind, below is a quick re-cap of Gurley’s Top 10 business characteristics for gaining entry into the “10x Club,” along with some added thoughts about how these apply today within Lock 8 Partners’ core focus area of small-scale SaaS businesses:

Conclusion:

Managing this 10X Scorecard can seem daunting; many of the components are interdependent. And in small-scale, resource-constrained SaaS business, the tyranny of the urgent can overwhelm even the best laid plans. While year-end brings the customary focus on the planning for the New Year, aligning those plans with your equity value aspirations is good discipline. Because, regardless of whether you’re doing $1M or $10B of revenue — and regardless of whether it is 2011 or 2021 — the characteristics of what makes a quality business remain broadly the same: sticky product, competitive moat, high gross margins, and bankable counterparties are critical for long-term success…and the market will value your business at its discretion.

Note: This is a loosely defined “Part 2” to a prior post entitled: “Pulling Up from the Weeds of Cash Conservation.”

There is an old English adage: Just because you can, doesn’t mean you should. As explained in this HBR article and per the website PhraseMix, “This phrase is usually used to give advice to someone who’s using their money, power, or skill in a way that’s not very wise.” This sentiment has particular relevance to leaders of small-scale SaaS businesses — not as a warning against an unchecked abuse of power, but rather as guidance around how they spend their most valuable commodity — time.

Taking a step backward, entrepreneurial leaders are overwhelmingly encouraged to be scrappy. Countless well-worn terms underscore the seemingly universal acceptance of this common wisdom: hands-on, roll-up the sleeves, leading from the front, wearing many hats, and servant leadership, to name just a few. The truth is that these terms are commonplace because this approach works well in growing small-scale businesses…until it doesn’t.

First, let’s look at some of the important benefits of a “can do” attitude in a hyper-engaged leader:

In these and other situations, leaders are motivated and rewarded for jumping into the fray with a versatile, “no-job-is-too-small” mindset. But these precise behaviors backfire as businesses begin to scale:

So how can leaders pull out of the weeds and find the right altitude, while keeping their feet on the ground? The truth is — like most issues of leadership — there are no easy answers. But disciplined leaders can consistently ask and answer a few questions to help make course corrections to help them fly right:

The road from “small-scale” to “growing” rarely follows a consistent, upward path; and there are few easy answers to the question of whether a leader should be above or below the “I can do that” line at any given moment. Rather, it’s useful to maintain a flexible mindset on this front. This will help leaders determine when to ascend or descend across various “altitudes” of learning, team building, financial stewardship, and many other responsibilities that fall under their purview. In a complex and constantly changing environment, it is well worth it for wise leaders to ask whether they “should” do things, even / especially when they clearly can.

As a card-carrying introvert, I’ve always found industry conferences to be exhausting. Likewise, over recent months, Zoom Fatigue consistently crushes me by mid-day Friday. So, I figured that a pandemic-induced remote conference would be some kind of “snakes on a plane” hybrid, uniquely designed for my personal torture. But, having just concluded my first honest-to-goodness attendance of a multi-day virtual trade conference, I am pleased to report that I was totally wrong. Rather, the SaaStr Annual at Home conference this week was engaging, informative, and — I can’t believe I’m writing this — energizing. Having been freed from the relentless distractions and demands of in-person conferences (networking, generating leads, striving to optimize investment in Travel & Entertainment), I paid much closer attention to the valuable content sessions than I normally would. I also appreciated moments of respite throughout the day which offered the opportunity to sense-make across sessions. The net result was a solid set of takeaways for a fraction the time / effort (and $); and I thought I’d share an eclectic mix of conference tidbits below.

1. “ARR is a fact, churn is an opinion:” This was a gem from one of my favorite sessions led by Dave Kellogg, who offered a fast-paced “how-to” of useful SaaS metrics. The specific point here is that churn can be defined and manipulated in many ways (true!), with collateral damage to the integrity of other metrics (also true). The broader point, which he supported with compelling data — focus on what matters to value-creation in the business. Roger that. (Session: “Churn is Dead. Long live Net Dollar Retention with Dave Kellogg”).

2. Remaining Performance Obligation (RPO) Intro: As a quick-and-dirty definition, RPO can be thought of as deferred revenue plus backlog. The Motley Fool offers a deeper explanation here, in connection to Splunk. This item came from the same “Churn is dead” session, which was the first time I’ve heard RPO referenced in connection to private companies. Makes total sense, and I’m eager to think about this more in the context of usage-based business models. (Session: “Churn is dead. Long live Net Dollar Retention Rate with Dave Kellogg”).

3. Managing Complex Change: Arquay Harris of Slack led one of my favorite sessions, and not just because she threw out the term Kobayashi Maru in her talk (her content was valuable and preso style was super-engaging). She referenced Sylvia Duckworth (the introduction to whose work alone was worth the price of admission) and shared the deceptively powerful graphic below which captures elements of managing complex change.

I’ve written here about principles of leading change, but I think this graphic captures these concepts in an amazingly clear, concise, and digestible way. There is a 100% chance I’ll be re-using this visual down the line. (Session: “The Secrets of Managing in All Directions with Slack”).

4. Committee Buying: It’s not our imagination, there is much more buying-by-committee mid-pandemic among enterprises who are increasingly risk-averse, cost-conscious, and looking to consolidate their technology investments. Lots of work to be done around understanding more / new buyer personas and how to sell into a flatter organization where any single person has veto power. (Session: “Buying Patterns in the Enterprise: Who’s Really Buying & Why in a Post-Covid World with G2”)

5. Privacy Debt: Bessemer Venture Partners shared six predictions around the 2020 State of the Cloud (janky photo below):

The one that really resonated with me was: “Privacy debt will be the new tech debt.” In short, SaaS players that have not been making consistent, diligent investment in their solutions’ privacy envelope will undoubtedly face a reckoning where significant, costly catch-up on this front will be unavoidable. I suspect tech debt will continue to be a problem for many companies, so I’d maybe argue that privacy debt is yet another straw on the camel named “Tech Debt.” (Session: “State of the Cloud 2020: The COVID Beneficiaries Edition with Bessemer Venture Partners”).

6. Fun Still Matters: Ben Chestnut, founder and CEO of marketing platform giant Mailchimp, shared a great story of the moment when his development team transitioned from being mercenaries (less-productive clock-watchers) to missionaries (self-motivated true believers). It was when they started programming Easter Eggs into the solution. The point? Having fun is incredibly powerful in terms of culture, talent retention, brand, and so much more. True that — awesome interview. (Session: “Learning from the Lows: How Mailchimp Navigated Economic Uncertainty”).

7. Vertical SaaS Rules (Part 1): There were a number of sessions that focused on issues relating to vertical-specific SaaS businesses. We are big fans of vertical SaaS at Lock 8, so I enjoyed these immensely. Damola Ogundipe talked about how being a vertical SaaS solution gives Civic Eagle a leg-up in recruiting because it is easier to identify for culture and passion (and not just talent) relative to horizontal players. (Session: “Underserved Markets for SaaS Companies with Backstage Capital, Avisare, and Civic Eagle”).

8. Vertical SaaS Rules (Part 2): Songe Laron, CEO and Co-Founder of Squire made a compelling argument for why vertical SaaS solutions have an inherent advantage over their horizontal peers in terms of increasing average revenue per unit (ARPU) within their focused customer base. That same session underscored the corresponding point that market sizes for vertical SaaS players were often a whole lot bigger than they first appear…and that domain expertise in that market enables savvy operators to unlock TAM that remains hidden to the casual observer. Exactly! (Session: “Vertical SaaS 2.0: How Barbershops Are Creating a SaaS Rocketship with CRV and Squire”).

9. D&I — Early but Mighty: The topic of diversity and inclusion was understated, but never far from center-stage at this conference; and it came up in various organic ways throughout many sessions. I also attended one session where it was the explicit focus (“Which D&I Initiatives Really Work: The metrics you should be tracking with Notion Capital”). That session crystallized a shared conviction that advancing D&I in SaaS businesses is not only the right thing to do, but that it is also highly correlated with value creation…even as we are still early-on in the collection of supporting empirical evidence. In sum, I sensed that (a) this will be a major focus for SaaS businesses that acknowledge there is much to be done, (b) there is early demonstrable progress being made, (c) it doesn’t appear that anyone has all the answers, and / but we are feeling our way together.

10. “On” and “In the Business” versus “Out”: There is a well-known distinction between “working on your business” versus “working in your business.” What I have sometimes found off-putting about software conferences is the seemingly obsessive focus on “working out of your business.” By that I mean placing overwhelming emphasis on exits, liquidity, and valuation. Don’t get me wrong, those things are extremely important; but they can also suck all the oxygen out of the room. In this crazy, tragic COVID reality we are living through, I found that NOT to be the case at this event. Rather, I found that people were very much focused on “working on their businesses;” and it was really refreshing.

And…1 to Grow On (Humble Pie is Comfort Food): Similar to the point above, there can be a lot of posturing that occurs at SaaS conferences, and this tends to escalate in direct correlation with SaaS company valuations. Although SaaS multiples remain durable, the past six months have been enough to inject a bit of humility into all of us. This seemed evident in most sessions, where I perceived a genuine air of people wanting to support one another and offer humble assistance where possible. It created a comfortable environment for a conference; I certainly hope this aspect of our current environment has some staying power.