One-size-fits-all seems to work fine for a few things. These arguably include: plastic rain ponchos, ping-pong paddles, the Flexfit ball caps that my dad likes to wear, and those awful grippy-socks handed out on trans-oceanic flights. For everything else, though, one-size-fits-all is brutal — always sub-optimal, often ineffective, and sometimes flat-out painful.

This principle holds true in many aspects of the small-scale SaaS world. And yet, we SaaS leaders consistently fall into the one-size-fits-all trap when it comes to customer engagement and setting up a formalized channel for soliciting actionable client feedback. There are many reasons for this including the fact that early-stage SaaS businesses often entirely lack an intentional approach to collecting market feedback; and launching an inaugural customer advisory board (often referred to by such acronyms as CAB, PAB, SAB, PUG, BUG, etc.) legitimately represents a major leap forward. Really, it does. Still, a one-size-fits-all approach to customer engagement can sometimes create as many problems as it solves. To describe and to combat that, this post draws on observations across many years & multiple companies to offer a framework for thoughtfully selecting an approach to customer engagement that best suits a business’ specific needs.

First, let’s introduce a few terms that will be useful to any discussion about programs for soliciting customer feedback:

· Focus groups / 1-on-1 Interviews: When conducting a focus group, researchers gather a group of clients / customers / users together to discuss a specific topic (or they do it on a 1-on-1 basis). Usually, the goal is to learn people’s opinions about a product or service, not to test how they use it. On this point, let’s draw a distinction here:

· Surveys: Standardized data collection from clients / users on a defined market or particular product.

· Tools / Data: Methods for gathering broader insights, including product usage stats, industry data, heat maps, A/B testing, etc.

· Client Groups: Convening knowledgeable clients who provide insight on the market and feedback about your solutions via the methods described above.

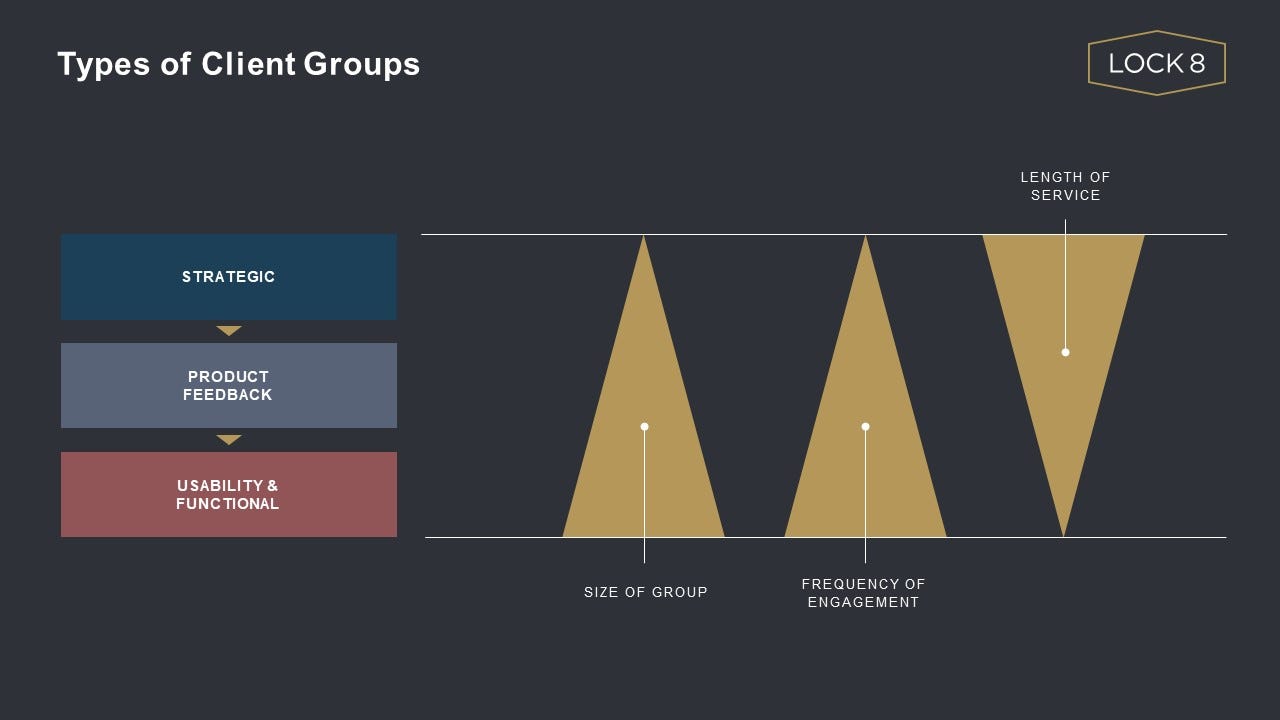

To be clear, all of these can be valuable, but this post focuses on the last of these forms of engagement — client groups. While there are arguably countless different flavors of client groups, we’ve observed three general types, as follows:

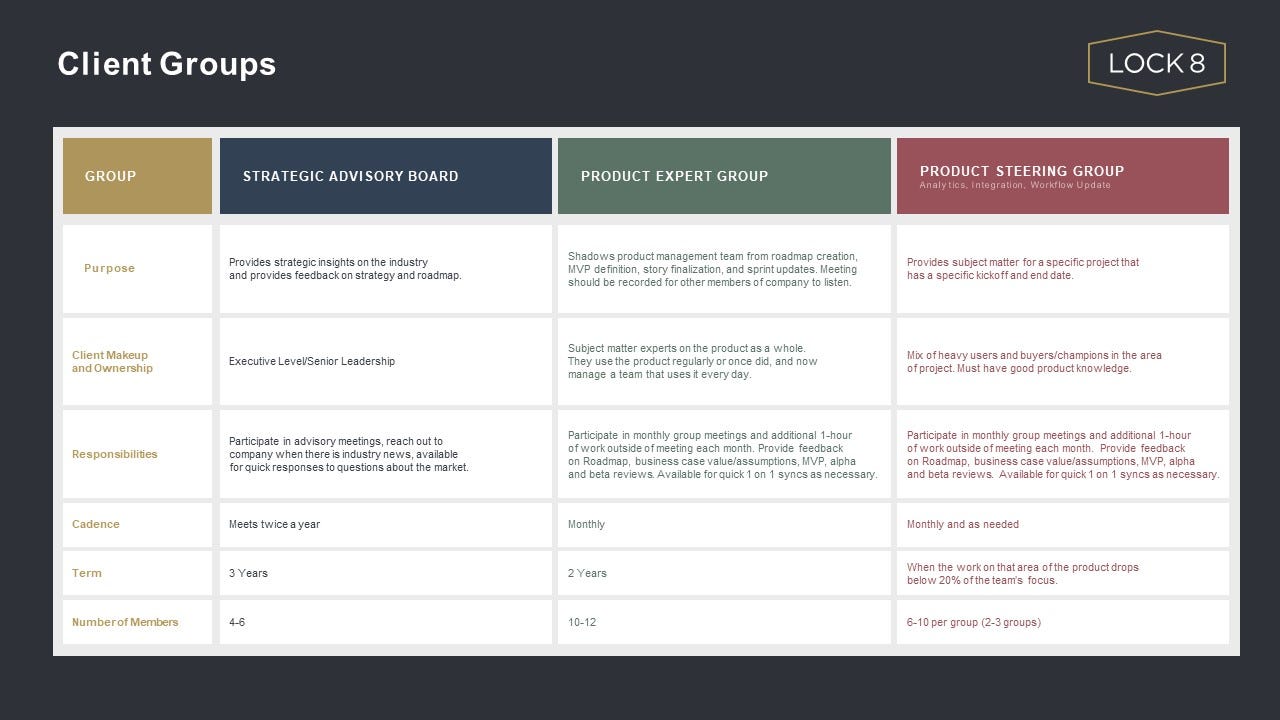

Hopefully these brief descriptions make a clear case for how each of these groups would serve vastly different purposes on behalf of a business. The graphic below double-clicks further into how these groups typically differ in terms of size, meeting frequency, and longevity of commitment.

To summarize:

The table below adds some quantifiable detail around how we tend to think about and structure programs for each of these types of groups.

To go one step further, and for those so inclined, it is also worth expanding upon this table as your programs become more formalized. We tend to add the following rows to nail-down additional criteria, including:

In closing, a few words about why these distinctions actually matter: Most importantly, small-scale SaaS businesses have a finite set of resources; and engaging with these groups is hard(!). We think about the challenges of managing user groups in two categories, as follows:

I. Time & Resources — it takes a lot of both; below is a set of related tasks:

II. Mixed Results — the hard reality is that these forums don’t always yield the expected outputs; below is just a small sampling of ways these groups can run off the rails:

As a SaaS business evolves its programs for engaging with customers, it would be ideal to simultaneously manage a portfolio with one (or more) of each of these user groups. Sadly, (to repeat) small-scale SaaS businesses constantly balance the tension between an infinite set of possibilities against tightly constrained resources. Given that, it’s important that they ruthlessly prioritize in all areas, including how to programmatically solicit strategic / product feedback from their clients. So…with many small-scale SaaS businesses looking first to mature to the point of having even just ONE of the customer feedback groups described above, it’s important to do so with intentionality. Because, as with most things, one size does NOT fit all…avoid the plastic poncho; and choose wisely.

A word of thanks to Paul Miller, ardent product management leader, now CEO, and previous thought partner to this blog, who recently helped me to crystallize “what good looks like” in terms of customer engagement programs.

3