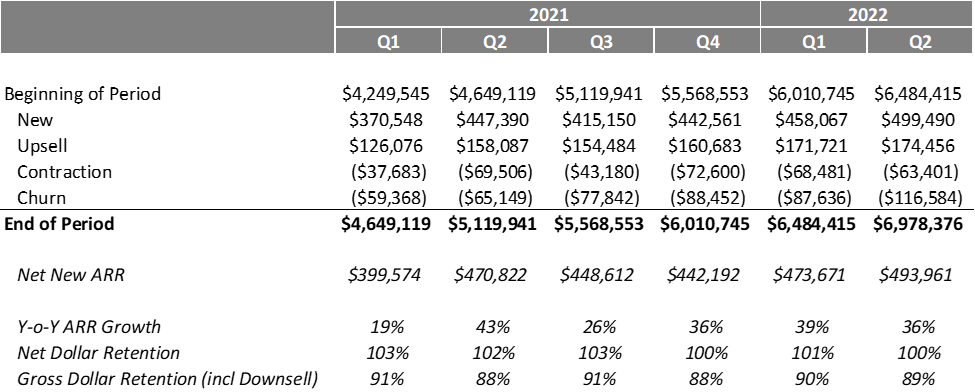

Over the past decade, the “ARR waterfall” or “SaaS revenue waterfall” has become a mainstay within the landscape of SaaS metrics and reporting. This is hardly surprising: operators, investors, and analysts all need a commonly accepted standard for assessing the topline performance of SaaS businesses; and the ARR Waterfall conveys so much in only a few lines (for this reason, I’d submit that the ARR waterfall is essentially the haiku of SaaS reporting…but I digress). As in the example below, an ARR waterfall neatly ties together new bookings, upsell, contraction, and churn into a structured, easily digestible story around the surprisingly complex question of how much net Annual Recurring Revenue (ARR) a business adds in each period.

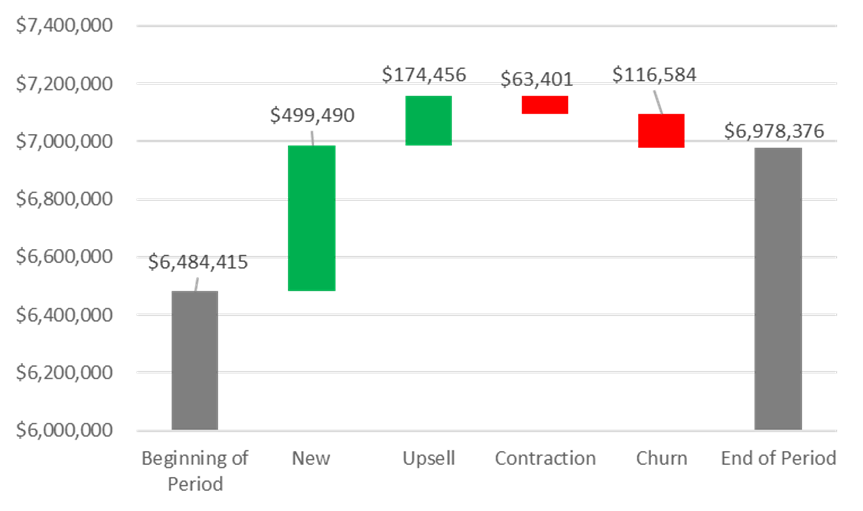

We also like a purely graphical / summary representation of this table, which is likely the source of the term “waterfall:”

This all works well in a prototypically tidy SaaS business: clients pay a specified amount for subscriptions to use a SaaS solution over a designated period, renewing that commitment at regular intervals. These renewals typically take place on an annual or monthly basis (or do NOT take place, resulting in “churn” or “drops”). Likewise, this quintessential SaaS business tends to offer graduated packages (“Good / Better / Best”) of its solution and/or allows customers to add or remove modules on top of a base subscription (“Core + More”). These add-ons lead to ARR expansion (aka “upsell”) but can also result in contraction when customers elect to scale back their licensed capabilities (aka “downsell”). In this scenario, new bookings, upsell, contraction, and churn all tend to be discrete, knowable, and quantifiable figures…in other words, comfortingly black-and-white.

The dirty secret within many SaaS businesses, however, is that the world is a lot messier and more complicated than ARR waterfalls would make it appear. Below are just a few examples of common nuances, along with the inevitable Good, Bad, and Ugly that each represents to SaaS providers trying to craft a tidy ARR waterfall — and, finally, some closing thoughts around how to manage such messiness:

· What if your business offers usage-based pricing, whereby clients get billed based on an amount of actual usage over a given period? Note: usage can be measured in countless ways (number of users, volume of transactions processed, database calls executed, and others).

· What if a benefit of your SaaS offering is the ability for clients to terminate contracts at their convenience and/or that these are evergreen contracts with no set renewal date?

· What if there is a mix of pure subscriptions (where clients manage their use of the software) along with technology-enabled reoccurring managed services (where the vendor provides admin and management of the solution on customers’ behalf)?

Before going any further, I’d offer that these situations are surprisingly common in the SaaS world. Many SaaS businesses, particularly those that Lock 8 invests in, offer such contractual nuances that go against traditional commonly accepted SaaS “best practices.” Although SaaS purists tend to poo-poo anything less than straight subscription revenue, customers often appreciate and ascribe value to these nuances (as Jason Lemkin wrote compellingly about here); and smart companies make the conscious decision to manage the tradeoffs described above. Some of the best companies we’ve worked with do exactly that. But…there is a catch. If your revenue model deviates from pure subscriptions, then it’s important to take steps to manage and monitor ARR reporting with great intentionality, as follows:

Now for the big finish to this post, please queue audio from TLC’s classic, and former Billboard #1 hit, “Waterfalls.” Per TLC’s timeless wisdom: “Don’t go chasing waterfalls”…instead, carefully Define, Align / Refine, Baseline, and Trend Line your own.