I’ll admit that I found it hard in the second half of 2022 to clear-off the white-space necessary to write many blog posts. Candidly, I’ve been in an extended slump on this front. When we find ourselves in a rut, it helps to have friends to lend a hand. With that in mind, I’m grateful to have many such friends in the early-stage SaaS community for just such situations. More specifically, I was delighted when James Marshall approached me with an idea for the “Made not Found” blog that leveraged his deep knowledge of analyst firms. The piece below is overwhelmingly the result of James’ experience and expertise, with a small bit of collaboration from me. Thank you, James, for generously sharing; and thanks to all for reading this post and helping the MnF blog get off the schneid early in ‘23.

Since my days of working for Gartner, I’ve learned to brace myself when mentioning B2B analyst firms to leaders of small-scale SaaS businesses. It’s not uncommon for one tech-leader to describe their industry analysts with admiration, and another to accuse theirs of downright corruption or extortion. A common sentiment is that paid research analyst engagements feel beyond our control, more akin to high stakes gambling than a rational, high-ROI growth strategy.

Over countless meetings with analysts, tech-CEOs, and investors, I’ve observed how great analyst-outcomes must be intentionally crafted by (and for) tech companies. Similarly, I’ve seen how analyst-related failures were quite predictable based on the actions taken (or not taken) by tech companies early-on in their engagements with analyst firms.

Let’s explore three common pitfalls to avoid, key questions to ask, and corrective actions to take. When thoughtfully navigated, these common stumbling blocks can become stepping stones, and serve as a strong foundation for meaningful analyst outcomes.

Pitfall #1: You invested money with analysts who don’t advise your target-market.

Too often, companies pay analyst-firms before confirming how those analysts plan to cover their space in the SaaS universe. This is a costly mistake that results in wasted dollars and time spent with analysts who don’t actively advise your target-buyers.

Key Question to Ask: Do these industry-analysts advise your target-buyers on how to buy solutions like yours? This is an especially critical point for vertical or niche SaaS businesses to confirm.

Key Action to Take: Analyst Interview — Just like you would interview someone for a position in your company, it’s important to take the time to properly interview any prospective key analyst. Discuss the below questions (and do so before any money changes hands!):

· How many conversations a month do you have with our target buyers?

· What is the most common business profile of these target-buyers you advise (revenue, employee count, industry, etc.)?

· What kinds of questions do our target-buyers ask you?

· What challenges are these buyers facing when choosing a solution?

· What kind of research do you plan to write this year? How will it help these buyers?

· Who are the biggest players in this space that my company competes with?

· Do you plan to rank vendors in this space? If so, what criteria will inform your decisions?

Questions like these are the beginnings of a high-leverage analyst engagement. From here, a well-executed engagement strategy will prove more attainable. Conversely, choosing an analyst based on brand awareness (or any other less informed criterion) commonly and predictably leads to dissatisfaction with one’s analyst.

Pitfall #2: You don’t have a strategy for turning analyst-investment into revenue growth.

While an unaimed arrow never misses, it’s best to approach analysts intentionally. This is especially true in the early days of working with an analyst.

Key Question to Ask: What steps can we take to convert the analyst’s influence into our firm’s revenue growth? This can also be a good question to directly and candidly ask the analyst (while acknowledging it is exclusively our job, not theirs, to drive our revenue growth). However, don’t be discouraged if they avoid specific talk of outputs (such as research mentions or referred business). Analysts closely guard their reputation of objectivity, so they generally won’t “go there” in terms of discussing tangible results…but achieving such outcomes remains possible.

Key Action to Take (#1): Identify Strategic Goals — Begin by internally outlining your 12-month goals for the relationship. There are three revenue-generating outcomes in analyst relations:

· Research Mentions: When your company is named in published research, your solutions get shortlisted more often. Your sales team can also leverage this research for instant credibility.

· Referred Business: During a direct conversation with your sales prospect, an analyst recommends that the prospect evaluate your company’s product.

· Insight that enhances your competitive position: This is the most overlooked benefit. As I’ll explain below, analyst-advice is directly correlated to the probability of being named in research or recommended for a shortlist.

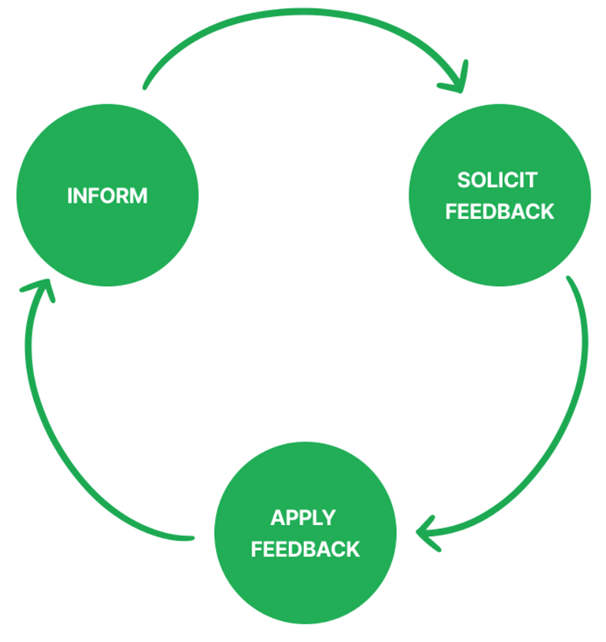

Key Action to Take (#2): Inform, Solicit Feedback, Apply — Here’s the secret: Nobody calls their own baby ugly; not even analysts. Leverage this human tendency by making analysts feel heard in some of your company’s critical decisions.

To illustrate this point, analyst-success can be distilled to the below cycle: inform the analyst about your product, solicit feedback, apply that feedback (if agreeable to your own vision), repeat.

Example: Ask the analyst to prioritize your feature-roadmap based on needs they see in the marketplace. This will be a valuable point-of-view that captures an influential analyst’s mindshare while helping to create an emotional investment in your company’s success. Their output could also save your company countless hours of internal debate!

Real-World Outcomes: The answer to your target-buyer’s question of “Who should we shortlist?” can be found among the vendors who ask that same analyst, “What features do you think are most important for our customers?” Analysts will shortlist vendors who align with their view of the marketplace. The same rule applies for tech companies hoping for favorable research coverage.

Pitfall #3: You’ve assigned the wrong people to speak with the analysts.

It’s common for tech leaders to invest significant capital with analysts, only to assign a lead-gen focused marketer to speak on behalf of their company. Those two parties can’t typically hold a meaningful conversation about your company’s strategy. Analysts catch on to this lack of investment in the relationship by leadership, and the impact to your brand is negative.

Key Question to Ask: Who in our company has the optimal blend of (1) seniority, (2) product / market vision, and (3) time to invest in relationship-building with the analyst?

Key Action to Take (#1): Put leaders in the meeting — The best people to speak with the analysts are the people with the blend of these three attributes; and those tend to be the CEO, the Head of Product, and the Head of Marketing (if they are responsible for packaging, pricing, and messaging…not just lead gen). Up until Salesforce surpassed $250m in annual revenue, Mark Benioff was well known at Gartner for his raucous debates with analysts. He even hired the analyst with whom he disagreed the most!

Key Action to Take (#2): Assign a separate show-runner — While tech leaders should be able to allocate the time to engaging substantively with analysts, they rarely have the bandwidth to establish, manage, and execute their company’s analyst strategy. Be disciplined about assigning someone to run the overall strategy of your analyst engagement, while surgically inserting the right leaders in the actual analyst meetings. This teamwork results in maximum impact. You can assign this strategy to someone internally or to an outside firm (just be careful to find one with real analyst experience, not a generic PR firm).

Conclusion: The Payoff — Intentional engagement with analysts creates significant momentum for businesses. That benefit is felt 10x for startups, where an analyst’s 3rd-party validation provides a level of credibility usually reserved for much larger companies.

For this reason, some tech-focused PE and VC firms spend millions of dollars each year with analyst firms. These investors mandate a well-executed Gartner and Forrester strategy as part of their value-creation playbook. Much the same, some SaaS founders and leaders are savvy analyst-relations pros who execute their own version of these strategies.

These leaders are in the minority and their analyst growth strategies are far from being a commodity. By taking the right steps to pair your company leaders with the right analysts, you can create an analyst-strategy that is a real accelerator to your company’s growth.