A colleague recently shared with me Benedict Evans’ tech trends for 2023 presentation. It’s amazing — 104 slides of compelling data that make sense of a dizzying range of topics, from interest rates to consumer behavior to global power-shifts to a new breed of digital gatekeepers. Before proceeding, I have two admissions to make: (1) I was previously somehow unfamiliar with Evans’ work; but I will pay closer attention going forward. (2) Although macro tech-trends conceptually interest me, I sometimes find it difficult to connect them back to our seemingly more pedestrian work of building small-scale B2B SaaS businesses. With these confessions in mind, this blog post is for practitioners like me. It cherry-picks just a few of the presentation’s many awesome slides and highlights points that struck me as particularly relevant to SaaS operators. It does not attempt or purport to summarize the presentation; and it’s certainly not comprehensive. Rather, it’s just a quick-share of my top takeaways — a codification of those points that I plan to revisit and bear in mind in the day-to-day fray throughout 2023. And they are…

Is it now time for the little players to have their day from an employment perspective? It was difficult during the pandemic for small-scale SaaS businesses to hire / retain top talent. To use a basketball term, the “possession arrow” in the resource economy seems to have shifted from employees back to employers. More specifically, with a quarter million veterans of big tech firms newly unemployed, what kind of a recruiting opportunity does this present for us? What roles could these people fill in our businesses, how best to recruit / on-board them, what support might they need to make the transition to small companies and to thrive in a less structured environment? This feels like a great, but fleeting, opportunity, let’s make the most of it.

2. Glass half empty, glass half-full (Slide 16):

This slide reminded me of an oft-cited pearl from the best software investor I know, “when it’s going well, things are never as good as they seem; and it’s never as bad as it seems when they’re not.” As a SaaS investor-operator, I found this slide encouraging. Particularly the last bullet: every market, every value-chain, every workflow, every customer engagement, every dataset is being rethought and remade — and there is still a ton of work to do on this front. When it can sometimes feel like every industry has already gone through digital transformation, this is an important point to remember. The following slide (about enterprise workloads in the public cloud) struck me as using different data to reinforce this same point.

3. Fragmentation (Slide 49):

This slide specifically addresses the steadily declining share of Nielsen ratings among the top-rated US TV shows over numerous decades. So, what does this have to do with small-scale B2B SaaS? What it highlights for me is that today’s most successful, top-performing shows only draw 10% of the available viewership. And they’re still winners. Perhaps not to the same degree as I Love Lucy back in 1955, but still massively successful. There are many niches, within which B2B SaaS businesses can thrive. And while they may need to garner more than 10% market share if they operate within a particularly small vertical, they don’t need to be all things to all people in order to prosper. If “focus is the friend” of SaaS operators, this is good news.

4. The ‘innovators’ dilemma costs real money… (Slide 55)

It’s hard to argue against being fist to market. But being the challenger does have advantages, and a lack of legacy baggage is one of them. This slide hammered home for me what small-scale SaaS operators inherently feel: it’s often more efficient / liberating / plain-old-fun to go-to-market as an innovative fast-follower than as the incumbent with tons to lose. Small-scale SaaS business should embrace that mentality and its many benefits.

5. Advertising is the price you pay… (Slide 69)

I’d never heard this fascinating 2009 quote from Jeff Bezos. And, although Evans goes on to illustrate that Amazon has since become the world’s largest advertiser, it’s a great reminder to budget-conscious SaaS operators.

In short, it puts a premium on ALWAYS focusing on ensuring that a business’ products are differentiated from those of competitors. Moreover, this highlights what is true in many vertical SaaS markets — that there are other, more effective means of communicating one’s go-to-market message (e.g. thought leadership content, earned media, word of mouth, customer references, community marketing, conferences, etc.). Said another way, should direct their energy into scalable and high-return organic marketing initiatives, rather than costly PPC efforts (aka advertising). Focus there.

6. The end of the American internet (Slide 95)

The “focus is your friend” axiom has a downside; and that is that it can foster short-sightedness. I found this slide to be a good reminder that even small-scale businesses should always be scanning the horizon to grow TAM and identify new opportunities to win customers. Wow, this slide is a mindblower — although the US may continue for some time to be the largest single market for B2B SaaS, other markets demand serious consideration.

I have no big finish to this post. Rather just a big thank you to Ben Evans for his fantastic work. It really is helpful, not just to the large players on which much of his work focuses…but also to small-scale operators who can learn from the trends he highlights.

I’ll admit that I found it hard in the second half of 2022 to clear-off the white-space necessary to write many blog posts. Candidly, I’ve been in an extended slump on this front. When we find ourselves in a rut, it helps to have friends to lend a hand. With that in mind, I’m grateful to have many such friends in the early-stage SaaS community for just such situations. More specifically, I was delighted when James Marshall approached me with an idea for the “Made not Found” blog that leveraged his deep knowledge of analyst firms. The piece below is overwhelmingly the result of James’ experience and expertise, with a small bit of collaboration from me. Thank you, James, for generously sharing; and thanks to all for reading this post and helping the MnF blog get off the schneid early in ‘23.

Since my days of working for Gartner, I’ve learned to brace myself when mentioning B2B analyst firms to leaders of small-scale SaaS businesses. It’s not uncommon for one tech-leader to describe their industry analysts with admiration, and another to accuse theirs of downright corruption or extortion. A common sentiment is that paid research analyst engagements feel beyond our control, more akin to high stakes gambling than a rational, high-ROI growth strategy.

Over countless meetings with analysts, tech-CEOs, and investors, I’ve observed how great analyst-outcomes must be intentionally crafted by (and for) tech companies. Similarly, I’ve seen how analyst-related failures were quite predictable based on the actions taken (or not taken) by tech companies early-on in their engagements with analyst firms.

Let’s explore three common pitfalls to avoid, key questions to ask, and corrective actions to take. When thoughtfully navigated, these common stumbling blocks can become stepping stones, and serve as a strong foundation for meaningful analyst outcomes.

Pitfall #1: You invested money with analysts who don’t advise your target-market.

Too often, companies pay analyst-firms before confirming how those analysts plan to cover their space in the SaaS universe. This is a costly mistake that results in wasted dollars and time spent with analysts who don’t actively advise your target-buyers.

Key Question to Ask: Do these industry-analysts advise your target-buyers on how to buy solutions like yours? This is an especially critical point for vertical or niche SaaS businesses to confirm.

Key Action to Take: Analyst Interview — Just like you would interview someone for a position in your company, it’s important to take the time to properly interview any prospective key analyst. Discuss the below questions (and do so before any money changes hands!):

· How many conversations a month do you have with our target buyers?

· What is the most common business profile of these target-buyers you advise (revenue, employee count, industry, etc.)?

· What kinds of questions do our target-buyers ask you?

· What challenges are these buyers facing when choosing a solution?

· What kind of research do you plan to write this year? How will it help these buyers?

· Who are the biggest players in this space that my company competes with?

· Do you plan to rank vendors in this space? If so, what criteria will inform your decisions?

Questions like these are the beginnings of a high-leverage analyst engagement. From here, a well-executed engagement strategy will prove more attainable. Conversely, choosing an analyst based on brand awareness (or any other less informed criterion) commonly and predictably leads to dissatisfaction with one’s analyst.

Pitfall #2: You don’t have a strategy for turning analyst-investment into revenue growth.

While an unaimed arrow never misses, it’s best to approach analysts intentionally. This is especially true in the early days of working with an analyst.

Key Question to Ask: What steps can we take to convert the analyst’s influence into our firm’s revenue growth? This can also be a good question to directly and candidly ask the analyst (while acknowledging it is exclusively our job, not theirs, to drive our revenue growth). However, don’t be discouraged if they avoid specific talk of outputs (such as research mentions or referred business). Analysts closely guard their reputation of objectivity, so they generally won’t “go there” in terms of discussing tangible results…but achieving such outcomes remains possible.

Key Action to Take (#1): Identify Strategic Goals — Begin by internally outlining your 12-month goals for the relationship. There are three revenue-generating outcomes in analyst relations:

· Research Mentions: When your company is named in published research, your solutions get shortlisted more often. Your sales team can also leverage this research for instant credibility.

· Referred Business: During a direct conversation with your sales prospect, an analyst recommends that the prospect evaluate your company’s product.

· Insight that enhances your competitive position: This is the most overlooked benefit. As I’ll explain below, analyst-advice is directly correlated to the probability of being named in research or recommended for a shortlist.

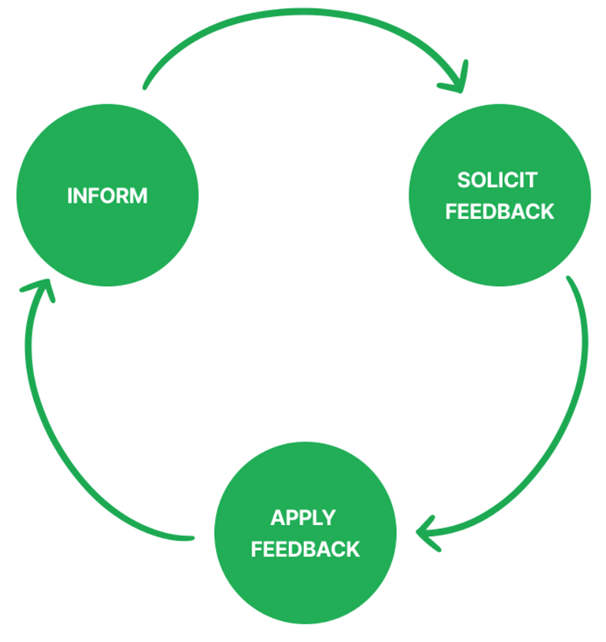

Key Action to Take (#2): Inform, Solicit Feedback, Apply — Here’s the secret: Nobody calls their own baby ugly; not even analysts. Leverage this human tendency by making analysts feel heard in some of your company’s critical decisions.

To illustrate this point, analyst-success can be distilled to the below cycle: inform the analyst about your product, solicit feedback, apply that feedback (if agreeable to your own vision), repeat.

Example: Ask the analyst to prioritize your feature-roadmap based on needs they see in the marketplace. This will be a valuable point-of-view that captures an influential analyst’s mindshare while helping to create an emotional investment in your company’s success. Their output could also save your company countless hours of internal debate!

Real-World Outcomes: The answer to your target-buyer’s question of “Who should we shortlist?” can be found among the vendors who ask that same analyst, “What features do you think are most important for our customers?” Analysts will shortlist vendors who align with their view of the marketplace. The same rule applies for tech companies hoping for favorable research coverage.

Pitfall #3: You’ve assigned the wrong people to speak with the analysts.

It’s common for tech leaders to invest significant capital with analysts, only to assign a lead-gen focused marketer to speak on behalf of their company. Those two parties can’t typically hold a meaningful conversation about your company’s strategy. Analysts catch on to this lack of investment in the relationship by leadership, and the impact to your brand is negative.

Key Question to Ask: Who in our company has the optimal blend of (1) seniority, (2) product / market vision, and (3) time to invest in relationship-building with the analyst?

Key Action to Take (#1): Put leaders in the meeting — The best people to speak with the analysts are the people with the blend of these three attributes; and those tend to be the CEO, the Head of Product, and the Head of Marketing (if they are responsible for packaging, pricing, and messaging…not just lead gen). Up until Salesforce surpassed $250m in annual revenue, Mark Benioff was well known at Gartner for his raucous debates with analysts. He even hired the analyst with whom he disagreed the most!

Key Action to Take (#2): Assign a separate show-runner — While tech leaders should be able to allocate the time to engaging substantively with analysts, they rarely have the bandwidth to establish, manage, and execute their company’s analyst strategy. Be disciplined about assigning someone to run the overall strategy of your analyst engagement, while surgically inserting the right leaders in the actual analyst meetings. This teamwork results in maximum impact. You can assign this strategy to someone internally or to an outside firm (just be careful to find one with real analyst experience, not a generic PR firm).

Conclusion: The Payoff — Intentional engagement with analysts creates significant momentum for businesses. That benefit is felt 10x for startups, where an analyst’s 3rd-party validation provides a level of credibility usually reserved for much larger companies.

For this reason, some tech-focused PE and VC firms spend millions of dollars each year with analyst firms. These investors mandate a well-executed Gartner and Forrester strategy as part of their value-creation playbook. Much the same, some SaaS founders and leaders are savvy analyst-relations pros who execute their own version of these strategies.

These leaders are in the minority and their analyst growth strategies are far from being a commodity. By taking the right steps to pair your company leaders with the right analysts, you can create an analyst-strategy that is a real accelerator to your company’s growth.

“Digital transformation is a foundational change in how an organization delivers value to its customers.” -CIO

“Digital transformation is the process of using digital technologies to create new — or modify existing — business processes, culture, and customer experiences to meet changing business and market requirements.” -Salesforce

“The essence of digital transformation is to become a data-driven organization, ensuring that key decisions, actions, and processes are strongly influenced by data-driven insights, rather than by human intuition.” -Harvard Business Review.

Digital transformation is clearly a hot topic that is top of mind for many business leaders. But for small-scale SaaS businesses, digital transformation can feel like something foreign that “doesn’t really happen here.” Maybe this is because the topic is often portrayed as being unimaginably massive in its scope and implications (per the above quotes); whereas growth businesses must focus near-term. There’s also a “feast or famine” aspect to this depiction; it implies that digital transformation is best suited to either (1) old-school industries with a pressing need to modernize-or-die (the “famine” camp), or (2) highly capitalized, bleeding-edge tech firms pursuing reality-bending innovations (the “feast” cohort). Neither is typically the case in small-scale SaaS businesses, nor is this positioning particularly helpful. Rather, we observe digital transformation within small software companies as taking place one step at a time; and it helps to avoid overthinking it. In this way, digital transformation looks less like otherworldly “foundational change” and more like workflow automation that is pragmatic, targeted, and high-impact. Below are some simple examples from the real-world of Lock 8’s portfolio companies, followed by a few takeaways from these cases.

Marketing and Sales:

Product and Client Success:

These examples help illustrate a few key takeaways related to digital transformation. First, purists would likely argue that the above are all pedestrian / tactical in nature; and they don’t truly represent digital transformation. Fine — potato // po-tah-to. As long as they contribute to meaningful advances in our ability to execute, we don’t care what they are called. Second, tackling such minor improvements is habit-forming. We’ve found that implementing each of these small improvements tends to reveal other worthwhile processes that can be enhanced with minor automation. Third, every aspect of the business is a candidate for such project-lets. The examples above focus on a few departments, but we’ve seen a focus on Sales and Marketing (for example) very quickly shed light on potential workflow changes in Finance, HR, and other parts of the business. And, finally, we’ve found this works best when everyone is invited to play in this game. There may be one person who is particularly talented in business systems — and that person can lead execution — but process improvement ideas need to come from anywhere and everywhere within the org.

Just as every great journey begins with a single step, the road to digital transformation starts with some simple workflow automation — don’t overthink it.

I stated in a recent post that developing a core set of disciplines is critical to the success of B-2-B SaaS companies. The main point being that such disciplines are universally valuable in virtually any market, but also pragmatically flexible and tactically applicable across a wide range of highly specific situations.

Because, like many things, this sounds good when you say it fast, the purpose of this post is to tackle this idea a little more slowly. The aim here is to explain and explore some of these disciplines more deeply, with an emphasis on (a) why they matter, (b) what they tend to look like within companies, and (c) how they measurably impact business outcomes. In the end, I’ll also present them within a framework to make it easier to mentally organize and actively implement them.

When companies build this set of 8 capabilities featured below, they generally put themselves in a very good position to succeed.

1. GO-TO-MARKET RIGOR: A purposeful, structured approach to what / why / how / to whom we sell.

2. TOP-LINE TACTICS: Detailed execution from top-of-funnel all the way through to successful sales, renewals, & upsells / cross-sells:

3. CLIENT JOURNEY MAPPING: Seeing the world through clients’ eyes & orienting around that vision:

4. OPPORTUNITY-LED INVESTMENT: Developing what matters most to the market and which it will reward with spend:

5. TEAM ALIGNMENT: More than just the right pieces; rather also how they fit and work together.

6. CATALYZING CULTURE: Growth mindset as a way of life & commitment to organizational health.

7. THOUGHTFUL GOAL-SETTING: Holistic attentiveness to inputs and outputs that sustain the business.

8. LEADING CHANGE: Highly developed ability to manage the one universal constant — change.

It’s important to note that one critically important discipline may seem conspicuous in its absence from this list: the capability to efficiently and effectively create world-class software solutions. I want to be careful to stress that this is so central to any SaaS business that it is a sine qua non that underpins and is interwoven into all of the other disciplines. This topic — appropriately — gets tons of coverage on this blog, so it has not been given top-billing here.

Admittedly, there is a lot to the 8 disciplines above; and they can certainly be a bit overwhelming. I find that thinking about them within a broader framework is helpful. Specifically, I like to organize them in a balanced way around a company’s primary stakeholder groups (described further in this post), with each of these disciplines addressing particularly well some of the core needs of each stakeholder group. This is what it looks like:

I find this format to offer a shared language and view for assessing the health of a company, diagnosing its pressing needs, and agreeing on priority areas for investment.

This framework continues to be an evolving work in progress, so please share any comments, questions or experiences you’ve had with any similar or divergent approaches. Oh…and…I don’t have a particularly snappy title for this framework, so if you have any recommendations, I’d gratefully welcome them — thanks in advance!

I wrote in a previous post about defining a SaaS business’ product vision, and in another one about orienting company operations around the needs of key stakeholder groups. Each of those activities plays a role in ensuring alignment and optimization of a company’s limited resources. I’ve since read this post from Josh Schachter which beautifully ties together those and many related ideas. His article “How Teams Can Outperform Using the Startup Ops Pyramid” introduces an excellent model for establishing a shared mission and “unifying any multi-disciplinary team on a single set of goals.” For years, our teams at a wide range of SaaS businesses have been using (and consistently inspecting & adapting) a similar model for this exact purpose. And while there are certainly some distinctions between our two models in terms of terminology and emphasis, my hope today is simply to build upon Josh Schachter’s excellent work.

Specifically, at the top of his Startup Ops Pyramid is the team’s vision. The article cites the very useful metaphor (made famous by former Medtronic CEO Bill George) of vision as true north for a team. It also establishes the key criterion that a vision must be simultaneously “aspirational, yet still relevant to present day.” The article provides some additional nuggets about vision, before moving on to discuss “vision pillars” (which our model would classify as “strategic pillars” (potato, po-TAH-to, as they say)) and other elements of the pyramid. What I want to double-click on here, though, is this crucially important — but maddeningly elusive — task of setting a team’s vision.

The bottom line is: setting a vision is hard. And frustrating. And, if not actively leveraged, commonly not worth the time and energy that goes into creating it. In many people’s minds, it’s right up there with crafting the much-maligned “mission statement” in terms of incurring organizational brain damage or inciting collective eye-rolling. But that doesn’t need to be the case; and I’m hoping the following points can help alleviate some of the pain — because successfully identifying your company’s true north is totally worth the effort.

More than anything else, I’ve observed what makes vision-setting hard is the monolithic and high-stakes nature of it. After all, the whole purpose is to distill the vastness of everything we are as a company and everything we want to become in the future into one statement. One single, pithy, inspiring-but-credible, non-constraining-but-also-non-delusional, universally-relevant-but-narrowly-applicable, not-too-jargon-filled, baby-bear-just-right kind of a statement. In other words, it’s extremely difficult to do, and in many ways is set-up for failure. Why? Because we want our vision / mission to be too many things to too many people and for it to do way too much. We expect the vision to be everything from the words we see on the splash-page of our website, to the opening statement we use in every sales call, to the ethos we use to recruit team-members, to the guidance we consult to set detailed performance metrics, to the all-knowing arbiter for helping us prioritize what features to build in our solution, and countless other tasks for which it is likely ill-equipped.

To battle this, my argument is NOT to grind away at defining and concisely codifying that one, shining true north. Nor is it to better delineate between terms such as vision / mission / strategy (although there are absolutely useful distinctions). Rather, I want to try to expand upon this idea of true north from being one single point of light, and re-imagine it as a whole constellation of separate, but intimately connected and interdependent guide stars, that a company can truly use to light the path forward.

Specifically, if we allow ourselves to temporarily avoid wordsmithing (i.e. forget about the loaded terms “mission” or “vision” and stop worrying about how it sounds!), we can ask and answer a whole series of questions that help us think more holistically about who and what we want to become. The collective output, of these simple but profound exercises can then be referenced as needed by a range of stakeholders. It can also be flexibly leveraged to more precisely fulfill the kinds of organizational needs described above. I call these “existential questions,” and a below are seven of them that we like to use to help create our constellation of true north stars:

1. What impact do we want to have on the world?

2. In a very general sense, what do we want to be as a company when we grow up?

3. What business are we in?

4. What is our product offering today and in its ultimate expression? Why, how, to whom (and against whom) do we sell it?

5. What are we passionate about? What are we good at? What will people pay us for? Where do all three of these things overlap?

6. What does the market think about us? How do we want to be perceived? What stands in the way of getting from the current to desired perception?

7. How do we want to work? What kind of environment do we want to create?

Using Your Constellation:

As I write this, I realize that there are so many more exercises that could be included in the list above. And yet, this seems like plenty for now. Hopefully, I’ve expanded Josh Schacter’s truth north vision from single star into a broad-based constellation of north stars to by which to navigate. The constellation can be referenced in all the ways the variety of stakeholders need: how to present ourselves in an RFP, how to represent ourselves in creating a job description, and how to talk about the product roadmap in a sensible and compelling way, for example. That’s a lot to ask of one, thoughtful, single vision statement.

But, far more important than the series of exercises, is how your organization chooses to view and use the work that comes from them. I have found that the collective output and learning from these types of exercises can offer a “true north constellation” that is at once specific and clear, but also flexible, broadly applicable, and pragmatically actionable — often far more so than a vision statement in a traditional sense. In my experience, this work is equally valuable either as a complement to your company’s existing vision statement, or as an alternative to the challenging task of crafting one.

Still, as we often say, “The hard work starts AFTER the meeting;” and this is absolutely the case in connection to these “existential questions.” Accordingly, I hope to focus a future post on steps to ensure the organization is actualizing the ideals envisioned in these exercises and getting better at doing so every single day.