I’ll admit that I found it hard in the second half of 2022 to clear-off the white-space necessary to write many blog posts. Candidly, I’ve been in an extended slump on this front. When we find ourselves in a rut, it helps to have friends to lend a hand. With that in mind, I’m grateful to have many such friends in the early-stage SaaS community for just such situations. More specifically, I was delighted when James Marshall approached me with an idea for the “Made not Found” blog that leveraged his deep knowledge of analyst firms. The piece below is overwhelmingly the result of James’ experience and expertise, with a small bit of collaboration from me. Thank you, James, for generously sharing; and thanks to all for reading this post and helping the MnF blog get off the schneid early in ‘23.

Since my days of working for Gartner, I’ve learned to brace myself when mentioning B2B analyst firms to leaders of small-scale SaaS businesses. It’s not uncommon for one tech-leader to describe their industry analysts with admiration, and another to accuse theirs of downright corruption or extortion. A common sentiment is that paid research analyst engagements feel beyond our control, more akin to high stakes gambling than a rational, high-ROI growth strategy.

Over countless meetings with analysts, tech-CEOs, and investors, I’ve observed how great analyst-outcomes must be intentionally crafted by (and for) tech companies. Similarly, I’ve seen how analyst-related failures were quite predictable based on the actions taken (or not taken) by tech companies early-on in their engagements with analyst firms.

Let’s explore three common pitfalls to avoid, key questions to ask, and corrective actions to take. When thoughtfully navigated, these common stumbling blocks can become stepping stones, and serve as a strong foundation for meaningful analyst outcomes.

Pitfall #1: You invested money with analysts who don’t advise your target-market.

Too often, companies pay analyst-firms before confirming how those analysts plan to cover their space in the SaaS universe. This is a costly mistake that results in wasted dollars and time spent with analysts who don’t actively advise your target-buyers.

Key Question to Ask: Do these industry-analysts advise your target-buyers on how to buy solutions like yours? This is an especially critical point for vertical or niche SaaS businesses to confirm.

Key Action to Take: Analyst Interview — Just like you would interview someone for a position in your company, it’s important to take the time to properly interview any prospective key analyst. Discuss the below questions (and do so before any money changes hands!):

· How many conversations a month do you have with our target buyers?

· What is the most common business profile of these target-buyers you advise (revenue, employee count, industry, etc.)?

· What kinds of questions do our target-buyers ask you?

· What challenges are these buyers facing when choosing a solution?

· What kind of research do you plan to write this year? How will it help these buyers?

· Who are the biggest players in this space that my company competes with?

· Do you plan to rank vendors in this space? If so, what criteria will inform your decisions?

Questions like these are the beginnings of a high-leverage analyst engagement. From here, a well-executed engagement strategy will prove more attainable. Conversely, choosing an analyst based on brand awareness (or any other less informed criterion) commonly and predictably leads to dissatisfaction with one’s analyst.

Pitfall #2: You don’t have a strategy for turning analyst-investment into revenue growth.

While an unaimed arrow never misses, it’s best to approach analysts intentionally. This is especially true in the early days of working with an analyst.

Key Question to Ask: What steps can we take to convert the analyst’s influence into our firm’s revenue growth? This can also be a good question to directly and candidly ask the analyst (while acknowledging it is exclusively our job, not theirs, to drive our revenue growth). However, don’t be discouraged if they avoid specific talk of outputs (such as research mentions or referred business). Analysts closely guard their reputation of objectivity, so they generally won’t “go there” in terms of discussing tangible results…but achieving such outcomes remains possible.

Key Action to Take (#1): Identify Strategic Goals — Begin by internally outlining your 12-month goals for the relationship. There are three revenue-generating outcomes in analyst relations:

· Research Mentions: When your company is named in published research, your solutions get shortlisted more often. Your sales team can also leverage this research for instant credibility.

· Referred Business: During a direct conversation with your sales prospect, an analyst recommends that the prospect evaluate your company’s product.

· Insight that enhances your competitive position: This is the most overlooked benefit. As I’ll explain below, analyst-advice is directly correlated to the probability of being named in research or recommended for a shortlist.

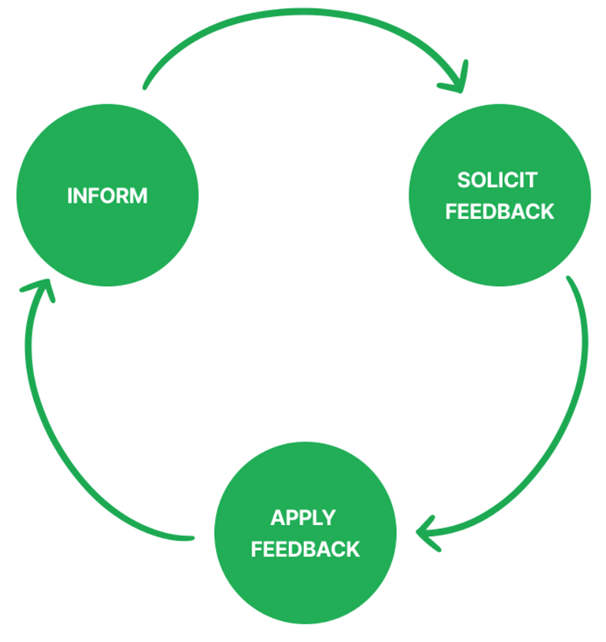

Key Action to Take (#2): Inform, Solicit Feedback, Apply — Here’s the secret: Nobody calls their own baby ugly; not even analysts. Leverage this human tendency by making analysts feel heard in some of your company’s critical decisions.

To illustrate this point, analyst-success can be distilled to the below cycle: inform the analyst about your product, solicit feedback, apply that feedback (if agreeable to your own vision), repeat.

Example: Ask the analyst to prioritize your feature-roadmap based on needs they see in the marketplace. This will be a valuable point-of-view that captures an influential analyst’s mindshare while helping to create an emotional investment in your company’s success. Their output could also save your company countless hours of internal debate!

Real-World Outcomes: The answer to your target-buyer’s question of “Who should we shortlist?” can be found among the vendors who ask that same analyst, “What features do you think are most important for our customers?” Analysts will shortlist vendors who align with their view of the marketplace. The same rule applies for tech companies hoping for favorable research coverage.

Pitfall #3: You’ve assigned the wrong people to speak with the analysts.

It’s common for tech leaders to invest significant capital with analysts, only to assign a lead-gen focused marketer to speak on behalf of their company. Those two parties can’t typically hold a meaningful conversation about your company’s strategy. Analysts catch on to this lack of investment in the relationship by leadership, and the impact to your brand is negative.

Key Question to Ask: Who in our company has the optimal blend of (1) seniority, (2) product / market vision, and (3) time to invest in relationship-building with the analyst?

Key Action to Take (#1): Put leaders in the meeting — The best people to speak with the analysts are the people with the blend of these three attributes; and those tend to be the CEO, the Head of Product, and the Head of Marketing (if they are responsible for packaging, pricing, and messaging…not just lead gen). Up until Salesforce surpassed $250m in annual revenue, Mark Benioff was well known at Gartner for his raucous debates with analysts. He even hired the analyst with whom he disagreed the most!

Key Action to Take (#2): Assign a separate show-runner — While tech leaders should be able to allocate the time to engaging substantively with analysts, they rarely have the bandwidth to establish, manage, and execute their company’s analyst strategy. Be disciplined about assigning someone to run the overall strategy of your analyst engagement, while surgically inserting the right leaders in the actual analyst meetings. This teamwork results in maximum impact. You can assign this strategy to someone internally or to an outside firm (just be careful to find one with real analyst experience, not a generic PR firm).

Conclusion: The Payoff — Intentional engagement with analysts creates significant momentum for businesses. That benefit is felt 10x for startups, where an analyst’s 3rd-party validation provides a level of credibility usually reserved for much larger companies.

For this reason, some tech-focused PE and VC firms spend millions of dollars each year with analyst firms. These investors mandate a well-executed Gartner and Forrester strategy as part of their value-creation playbook. Much the same, some SaaS founders and leaders are savvy analyst-relations pros who execute their own version of these strategies.

These leaders are in the minority and their analyst growth strategies are far from being a commodity. By taking the right steps to pair your company leaders with the right analysts, you can create an analyst-strategy that is a real accelerator to your company’s growth.

At Lock 8 Partners we spend a lot of time chatting with, and learning from, operators of SaaS businesses. It was in that context that I began trading notes with James Marshall mid-way through the pandemic. In addition to having an impressive track record of leading sales teams, James has generously shared with me his thoughtful views on the never-ending evolution of sales teams. It was on this topic that James and I recently collaborated; and he was kind enough to codify some of his thoughts. Thanks, James, for contributing the following post to the Made Not Found blog!

___________________________________________________________________

Introduction:

SaaS sales leaders find themselves in a crucible chapter for B2B sales, as the pandemic has accelerated trends that pressure sales leaders to modernize. To outperform their competition, the best sales leaders will embrace both the 1) digital transformation of their sales organization and 2) the evolution of their sales processes. Although these may sound like daunting endeavors, there are a few easy wins that can have an immediate impact.

Covid-19 and the Battle for Talent:

A limited talent pool and increased competition for candidates is driving sales into a stage of discomfort. Prior to Covid-19, the recruiting battle for sales professionals was already stretching a limited pool of sales talent; and the pandemic has greatly accelerated this trend. Through the normalization of remote work, North America’s hottest tech centers are now empowered to recruit outside their city limits for perhaps the first time in their existence. Fueled by historically sky-high valuations, tech companies from North America’s hottest startup zones have an edge in the battle for a limited talent pool. Put simply, that enterprise sales rep in Knoxville, TN who could historically be recruited by their local startup ecosystem for a $225k OTE (on-target earnings), is now entertaining job offers from Silicon Valley and Austin, TX for $350k OTE.

Technology companies everywhere are being forced to compete for this talent and increase wages for salespeople. However, sales productivity metrics aren’t changing nearly as quickly as a reps’ base salaries. We all know that high OTE’s mean correspondingly high quotas. Studies done by Salesforce have shown that more salespeople expect to miss their FY sales quotas than attain them. According to Gartner, only 6% of Chief Sales Officers are extremely confident about meeting their revenue goals in 2021.

Sales Productivity Must Increase:

It goes without saying that against this backdrop, sales productivity must increase. Fortunately, there is some fruit — while not quite low hanging fruit — that is within reach for businesses that take the time to revisit their sales process. These advantages are found through unlocking the combined benefits of sales technology platforms and sales process innovation.

Platforms: The Digitally Enabled Rep

While it’s often said that today “every business executive is a technology executive,” too often sales leaders have lagged behind their peers. Whereas 84% of marketing teams leverage AI, just 37% of sales teams do. And of that 37%, I commonly observe sales teams with access to a wide array of tools (e.g. an outbound automation platform, a contact database tool, a conversational intelligence platform, Sales Navigator, a video prospecting platform, and a myriad of great plugins for their CRM), but where team productivity is undermined by low user adoption.

Yet the data is clear: companies that leverage AI-driven sales platforms outperform those who don’t. Whereas 57% of top-performing sales teams leverage AI-empowered sales platforms, only 31% of moderate performers and 20% of low-performers leverage AI in their sales process.

Contributing factors to this low-adoption stem from leadership’s comfort level with sales technology. We commonly observe that sales leaders themselves haven’t made the jump into tech-enabled selling. As a result, many 1) don’t feel comfortable coaching their teams to utilize these technologies as part of their sales processes, and 2) purchase technology without accounting for the sales rep’s user experience.

The great news is that SaaS ecosystem for sales has innovated well beyond the current state of its user community. The best sales leaders will evolve their sales processes to support robust utilization of these products, which will bolster their sales reps’ productivity. The return on this investment is swift and certain. More on this in a future post.

Modernize the Sales Process:

The typical B2B SaaS marketing department has evolved to be the data-driven, tech-enabled functional area that it is today. Conversely, the enterprise field-sales process has evolved very little since the industrial age. In the late 19th and early 20th century, John Rockefeller’s Standard Oil ran a large field sales organization where geographically based salespeople opened new accounts and grew existing ones. Unfortunately, the pace of change in our complex world makes it extremely difficult for today’s reps to “do it all,” as their predecessors did. If that sounds like your company’s sales process, I rest my case.

As an alternative, many successful companies divide the sales responsibility into two and three parts (BDR, AE, and to some extent Customer Success). However, even these models fall short of 1) breaking down the motion of sales-led growth into its simplest parts, and 2) assigning those parts to the most competent and cost-effective people and platforms to execute them.

As a quick illustration, let’s look at how a salesperson spends their time and assign a dollar value to their daily tasks. For the sake of argument, we’ll say that this is a “Field Salesperson” who is receives $250k of annual compensation in exchange for 45 hours of their time and attention each week. At $115 an hour, the business has no doubt hired this person for their ability to sell large deals. Yet in 2018, salespeople reported spending just one-third of their time actually selling. The culprit? Data entry is certainly one of them; and in the case of our example rep, date entry comes at a cost of nearly $700 per day. And, that figure comes before we’ve started analyzing how much time a rep spends on building lists, outbound prospecting, creating sales collateral, etc.

By neglecting the work of sales process innovation, companies are overpaying for customer acquisition. We’ve found that clearing the calendar for even one day of planning often allows sales leaders to identify targeted areas for process improvements that shorten the sales cycle and / or lower CAC.

Many startups and small companies will argue that while this kind of role-specialization would be ideal, they are too small to capitalize on it. Fortunately, the white-collar gig economy is stronger than ever through websites like Upwork and Fiverr. Through some simple privacy accommodations, startups are able to utilize this outsourced talent pool, while quickly segmenting their sales process and increase their effectiveness.

Conclusion:

In this environment of increasing expectations, sales leaders have two levers which are well within reach. Sales leaders will gain a competitive advantage by 1) driving user adoption from the rich ecosystem of sales automation technologies available, and 2) analyzing their sales process for opportunities to innovate. Today, it’s not hyperbole to say that any startup or midsize SaaS company is just a few tweaks away from unleashing a force of digitally enabled salespeople who are focused on executing their highest-impact revenue activities. When that happens, everybody from salespeople to investors win.

At our pre-wedding rehearsal dinner, one of the groomsmen made the following toast: “A person is judged by the company they keep. And, although I’m not all that crazy about Todd, his friends are truly amazing!” It was one of the best compliments I’ve ever received.

In the 20-something years since, that dynamic persists: I’ve been fortunate to meet, collaborate with, learn from, and befriend many remarkable people in and around small-scale SaaS businesses. Some of them have generously shared their wisdom on this blog (such as here and here). Today that practice continues with some sage advice from Robert Morton.

I met Robert during our shared time at Blackboard; and now the guy just can’t shake me. A true lifelong learner, Robert has continued to expand his formidable skills and push the boundaries around how to build durable businesses and relationships. He recently hung up his own shingle as a growth and customer insight / experience consultant at Highland Advisors (full disclosure, Lock 8 is a proud client). He also recently wrote passionately about the concept of consequentialism as it relates to customer experience. With Robert’s blessing, I share those thoughts below. Thank you, Robert; here’s to consequentialism:

Every time I read another company drone on about “we strive to put customers first”… only to follow with some weasel-ey, anti-customer move, I’m reminded just how badly most outfits need a dose of consequentialism. A mouthful of a word but the gist is this…

Your intent doesn’t matter, what’s in your company heart doesn’t matter… there’s just your actions and what they result in.

If the move you’re making improves customer value, it’s a customer centric move.

If the move you’re making chips away at customer value, it’s an anti-customer move.

That’s it. What you mean, or how well you wax poetic about your customer-centered beliefs, doesn’t count. In this view there are just actions and a tally of outcomes over time that add up to a more customer-centric or more anti-customer bearing as a company.

Over-simple? Maybe. Isn’t intention a mark of seriousness and care in the approach to just about anything? Perhaps.

But I’ll wager we’d have better customer outcomes, with a lot more impact per word, if we at least passed a consequentialist lens over all the customer (employee too, likely) moves we make.

No self-soothing with noble intents or rationale gymnastics allowed. Just the cold light of asking ourselves “is the outcome of this thing we’re planning customer-centric or anti-customer”? And if the latter, “how do we feel about that, what do we want to do about it”?

And if you believe as I do that the conversations you have shape the culture you have, simply posing and wrestling with these questions in the open carries its own very powerful reward.

Because when we do, we change the accepted language and conversation of our orgs. Turning more of our everyday work gabs into open development discussions about the customer (or employee) experience we want to make here.

And that, more than any single CX decision we end up making, may be the most consequential move of all.

From time to time, we use this forum to share observations and trends from webinars or virtual conferences (here); and sometimes we invite guest-bloggers to offer insights from their own experiences (here and here). This post does both of those things at once. Our friend and peer, Mike Dzik, is a Growth Partner at Radian Capital (full disclosure: one of Lock 8’s investors), where he works with Radian’s portfolio companies on their respective go to market strategies spanning marketing, sales and customer success initiatives. Last week, Mike attended the TOPO Virtual Summit a three-day virtual conference for sales, sales development, and marketing practitioners; and he was generous to share with us his impressions of the event. He’s also agreed to allow us to share those observations here on Made not Found. So, with no further ado, I’ll turn it over to Mike, below:

I hope everyone is doing well and off to a fast start for Q4. I spent some time attending the TOPO Virtual Go To Market Summit this week and wanted to share 5 key themes surrounding 2021 (below).

Thanks, Mike, for these pearls. There are so many good virtual events out there; and it is impossible to free up the space to attend them all. We’re grateful to benefit from your participation in, and distillation of, the thought leadership coming out of the TOPO Virtual Summit.

-Todd

In a previous post, I shared observations relating to the process of re-platforming a SaaS solution. I was grateful when a former colleague reached out to comment on that piece. He offered that the term “SaaS” was somewhat limiting in this case, and that the principles in the post applied to any number of modern software delivery models. And, because no good deed goes unpunished, I asked him to guest-write an article that topic. Thankfully, he agreed! Chad Massie is highly qualified to opine on the issues encountered when deciding how to utilize cloud services while modernizing the architecture of a SaaS solution. I’m delighted to share his thoughts on this topic on Made Not Found. Thank you, Chad for the post that follows.

____________________________________________________________

For any business, but especially for those providing software as a service, cloud infrastructure offers a tremendous opportunity to drive organizational value. The question is not if a cloud strategy is appropriate, but rather which strategy to pursue and how to ensure that business and user value drive the decision-making. The five observations below were developed over five years of operating a high volume, high availability, cloud native software platform, and though there are several technical take-aways, the most important lessons are the human ones. Those observations and the related reflections on people and teams are below:

There is no single cloud strategy

In ways that can be both advantageous but also challenging, not every software or business will be best served by the same cloud strategy. This provides great flexibility in terms of timing and investment, but it also signifies that time spent up front posing the essential questions, understanding the needs and clearly defining the desired goals, and establishing the acceptable risk profile will pay considerable dividends (e.g., start with why).

The primary question of whether to “rehost” or “replatform” or “rearchitect” has no obvious answer. Each of these approaches has pros and cons — from a technical perspective, of course, but just as importantly from cultural, operational, and business value angles — and all can offer benefits for your organization. A rehosting strategy can help reduce near-term risk but might slow the upside value for an aging application; rearchitecture can provide a path for addressing major technical debt and modernizing the user experience but brings with it more significant complexity and change that may be more than your business or team is in a position to accommodate. Again, understanding your own context and priorities will help lead you to a better decision for your organization. You might determine that experimenting with an application that has a lower risk profile (e.g., an internal application, a non-mission critical platform) or a specific operation (e.g., disaster recovery) is the path that will ensure long term success, or you might determine that an all-in approach is the way to best serve your customers and inspire your staff.

Cloud is a culture (change)

Processes, organizational structure, and technical strategies that were foundational to success in an on-prem or hosted SaaS operation will not necessarily translate in a true cloud environment. The cloud requires a shift in cultural thinking, and as a result, demands a well-considered change management strategy for your team(s). One common theme is establishing a Devops mindset whereby the members of your various technical teams are involved in the full lifecycle of product delivery and support. Another is fostering an environment of knowledge-sharing and a blamefree ethos. The amount of new learning to be performed and the pace of change in cloud technologies require open communication, collaborative work, and “failing forward.” Further, the culture of learning and partnership requisite to success in the cloud extends beyond technical roles; product, marketing, finance, support, and management positions will all see implications to their work and their team interactions as a result of a cloud-oriented strategy. They must be incorporated into the transition planning and energized by the opportunities every bit as much as the technologists.

Patterns are your friend

Similar to the way software and user experience patterns have emerged over time, there exist many proven cloud architecture and process patterns that can help reduce effort and risk while ensuring security and operational reliability at scale. Whether incorporating elements of Amazon’s well architected framework, pillars of great Azure architecture, or Google’s cloud adoption framework — or something else — make use of these cloud patterns to shorten the time it takes to realize benefit for your organization. As with anything in life, though, an extreme position can limit our perspective, and cloud architecture is no different; it is both a science and an art. The scientific patterns and frameworks should be used to help streamline your architectural approach, but their parameters shouldn’t get in the way of your team’s creativity, the practice of experimentation, and applying their unique contextual knowledge in crafting the most valuable solutions for your business.

Instrument, monitor, and automate

Cloud infrastructure and the technologies that have been developed to support cloud-based software lend themselves extremely well to measurement and instrumentation. The fidelity of this information provides exceptional insight into the operations of your technical platform, in identifying issues proactively, and in understanding user behavior. Additionally, since utilization of a cloud infrastructure eliminates the dependence on physical hardware and enables access to on-demand scale, your strategy should push to automate as much as possible. Besides reducing repetitive efforts, automation will diminish the risk of human error and security exposure, increase overall quality, and help in delivering an optimal experience to your end consumers.

The cloud is constant innovation and reinvention

Advancing a cloud infrastructure strategy is an amazingly exciting journey. The dynamic nature of the landscape forces evolution and thoughtful change. As with any sound technology strategy, it demands attention to maintenance, performance, and reliability, but it also provides for reinvention and innovation in manners that did not exist previously, especially for small and medium sized software businesses. Rather than investing large amounts in original R&D, you could choose to utilize your cloud vendor/partner as your R&D arm, investing your resources in making the most of the innovative assets they bring to market while also providing enormous professional growth opportunities to your team. A cloud architecture gives you much more flexibility and a broader range of strategic options than has been historically available to SaaS companies, allowing you to select an approach that best meets the needs of your business, your team, and your customers.

Though the pathways toward a cloud architecture are now much more well-worn than they were several years ago, each software platform and each business is different. Coupled with the reality that cloud technology is a perpetually changing environment, there are no universal strategic approaches that will guarantee success. However, if you start with the right questions and understanding of the business drivers, build a work and communication plan aligned around strategic goals, and advance a team culture that values learning and collaboration, I believe the lessons above are applicable globally and can help ensure that your organization reaps a cloud strategy’s tremendous benefits.

I have admired the work of Walker White for years and have valued the opportunity to compare notes and share lessons-learned with him during that time. At this point, I am excited to explore ways to expand and deepen that collaboration. With his recent transition following a long and successful run at BDNA and its acquirer Flexera, Walker will play a more active advisory role to Lock 8 Partners. This week Walker shared on LinkedIn some of his thoughts and observations from 25 years in leadership roles in the tech space. His post really resonated with me, and I wanted to share it here on the Made Not Found blog.

After 25+ years, it is time for me to shake it up and pursue career 2.0. I’ve been fortunate to be entrusted with leadership roles over that time, and in an effort to continue learning, I kept a running list of quotes and anecdotes that struck me. As it is good to pause and reflect during any transition, I recently found myself reviewing that list. Sometimes with a chuckle and other times with a sigh, I was reminded of when I heard them, what they meant to me, and how I put it into action (or didn’t, hence the sighs). I thought I would share four of my favorites:

When you hear a quote or anecdote that resonates with you, take the time to jot it down. In my experience, so much of leadership is common sense, but the pace of the day-to-day often caused me to over think the best solution. Simple quotes — like those above — always served to ground me back to what really mattered and more often than not illuminated that which I had overlooked.

Still learning and laughing,

Walker White

Walker White recently left his role as Senior Vice President of Products at Flexera to pursue Career 2.0. Prior to acquisition by Flexera, Walker White was the president of BDNA Corporation. He is passionate about helping organizations excel by building the right team and culture, setting and communicating a compelling vision, and driving momentum through courageous decisions.