The television series Undercover Boss has been a guilty pleasure of mine for years. Now entering its eleventh season, the show features “high-level corporate execs (who) leave the comfort of their offices and secretly take low-level jobs within their companies to find out how things really work and what their employees truly think of them.” For cringe-worthy viewing, this one totally hits home for me.

But I also like the show’s more serious theme of “walking a mile in someone else’s shoes” in order to deeply understand that person’s experience. At Lock 8, we’ve adapted this concept to help provide insight into a key focus area for small-scale SaaS businesses. Whereas Undercover Boss leverages this approach to offer candid employee-level views into the internal workings of companies, we hope to shine a light on the experience a customer has when evaluating, selecting, and adopting a B2B software solution.

On the surface, this is a straightforward endeavor, involving a few simple steps:

Simple enough, right? Not really. Like so many things, this is easy to do poorly, and extremely difficult to do well. To help make it easier, this post will share a few tips relating to each of these deceptively challenging steps.

1. Pretend You Are a Prospect: At its most basic level, this is a role-playing exercise, so it’s absolutely critical to play your role well. This may be relatively easy for the undercover bosses referenced above (they get a cover legend and a disguise; and they go), but it is more complicated to get inside the mind(s) of a purchasing committee for a large and complex corporate enterprise. We’ve learned that it is definitely worth investing the time and effort to make it real: have a dossier, real personas, real business problems you’re solving for, deadlines, budget constraints, and even political motivations. Even go so far as to designate a few people to play different decision-maker roles. Balance the company profiles to reflect your current (vertical) targets, your buyer personas spectrum and the maturity of organization using your solution. Marketing absolutely should help develop these resources. Here’s a snapshot of just part of a dossier created by a portfolio company that recently executed such an initiative.

An additional point about this step: BE OPEN! Unlike the undercover bosses, for whom secrecy is paramount, this should NOT be a clandestine endeavor. The reality in software companies is that everyone somehow touches the customer experience. Likewise, our experience is that people in early-stage SaaS business are all operating in good faith, so there is no need to trick anyone or attempt to trip them up. Rather, everyone needs to know you’re undertaking such a journey; and each functional area needs to be part of the process. Now…you may need to make the case: why it’s important; why we need to get it right; who’s involved; what we’ll be doing; how we’ll share feedback. But these are all further arguments for doing this out in the open. Equally important: everyone at the company should hear later what was discovered, and to view the information as a learning opportunity, not a judgement. Nothing makes people more nervous than being excluded from understanding what’s happening behind the scenes or feeling like this is a test.

2. Go Through the Steps: Uh…what steps? Whereas most businesses have established a sales process with related stages and activities, these usually assume a company-centric approach, and overwhelmingly ignore the customer perspective. Customers’ motivations / activities / dynamics are effectively infinite, so identifying their purchasing steps can be paralyzingly complex. To simplify, we like to organize our efforts around “major stages” of the customer’s lifespan with a software solution. Although every product / system / technology is unique, there is a relatively small number of macro-phases on the customer journey; and these are generally consistent across different solutions. The purpose of the mental model and accompanying graphic below is to align perspectives, offer a shared vocabulary, and provide structure to the exercise.

On the principle that a picture is worth a thousand words, I’ll hope this graphic is self-explanatory. In summary, as we engage in countless customer “buying” and “owning” activities, and we organize them into these six phases: (1) awareness, (2) evaluation, (3) decision, (4) on-boarding, (5) use, and (6) advocacy. One note of caution: for complex solutions, this may end up being a grueling multi-month process. It’s important to know what you are signing up for in advance…and what your customers are going through to buy / use your products.

3. Record Your Experiences: A disciplined collection of notes will generate consistency of insight and evaluation. With more than one person involved the experience, it’s important to provide a consistent way to gather intel and feedback. That said, this doesn’t require over-thinking; and a simple note template suffices. We like an “Experience and Expectation” framework (“what did I expect?” and “what did I experience?”) to structure things. Then, just codify the experience in a linear way — capture in detail and in chronological order what happened and how it impacted the buying / owning processes outlined above.

4. Articulate the Ideal: It’s nearly impossible to simply dream up the ideal client experience, just like it is unheard of to nail product-market-fit on version 1.0 of a solution. Instead, it pays to inspect and adapt. Thankfully, the early steps of this exercise, and the current-state baseline they provide, offer an awesome foundation from which to iterate toward a vastly enhanced client experience. As a result, this step can be as simple as revisiting every step along the journey and answering the following question: “what would have made this much better?” In the best case, this can lead to a wholesale re-thinking of the journey; at a minimum, it will radically improve the existing steps of the experience.

5. Identify gaps; build a plan: For the activators in the crowd, this is the payoff where you can begin to implement necessary improvements. But be careful about succumbing to temptation. It is alluring to focus energy on an ad hoc basis to address the low hanging fruit that can be fixed easily. The problem is that this approach can break any number of existing processes that — although they may be sub-optimal — generally work today in the context of the current approach. So be careful about what you choose to “fix” as a one-off — it could just break other areas of your process. Although it requires more patience and offers delayed gratification, an orchestrated program overhaul will undoubtedly yield more substantive improvement of the overall client experience. Make a plan and take your time in executing it. Our experience is that the “customer experience re-engineering” project to come out of this exercise may take months or even years to implement.

As with most pressing, cross-company business issues, initiatives like creating an awesome CX Journey can take on a life of their own. Proceed with caution here; ensure that anything and everything you chose to do ties back to your overarching business needs. Such an effort must involve more than just the bosses; and there is no need to go undercover — doing so will allow companies to walk in their customers’ shoes…a journey well worth taking.

A prior post explored the concept of customer effort as a critical driver of customer loyalty. That piece referenced Gartner research / articles (here, here, and here) which argued that creating an effortless customer experience — far more than raising customer satisfaction — is the key to retaining customers’ devotion. The data doesn’t lie; and I certainly buy into the concept. To a point.

On further reflection, though, I have a few reservations. These doubts are based on nuances specific to enterprise software and customers’ experience with business-to-business SaaS solutions. Gartner’s research appears to have been broad in scope; it seemingly covered customer service interactions around consumer products / services without focusing on specific industries. This post seeks to double-click into some subtleties to consider around customer effort, with emphasis on these dynamics within the B2B software environment.

1. Timing Matters: In B2B software, timing matters when it comes to customer effort. There is a fundamental distinction between the initial set-up period when the software is being implemented, versus the downstream steady-state period when the solution is being leveraged in a live environment by active end-users. For the sake of clarity, we might characterize these two phases / timeframes as “project” work (up-front) versus “process” work (downstream). Notwithstanding the rise of low-friction, freemium 2nd generation SaaS solutions, many complex business solutions still require thoughtful up-front project work. And, although the SaaS model has vastly simplified and accelerated technical aspects of software set-up, rolling out business solutions still demands organizational commitment of time and resources to do so properly (e.g. mapping processes, configuring work-flows, integrating with existing systems, and supporting user adoption). Gartner’s research in support of low customer effort appears to have excluded that start-up phase (project work) and focused primarily on downstream customer support inquiries (process work). The reality is that customers still need to invest to some degree in project work, even if their appetite for downstream process work is prohibitively low.

2. Value Matters: Building on the point above, savvy institutional software customers acknowledge some amount of up-front work is required to get great downstream value from a technical solution. And while all organizations strive to minimize that work (and time), they appreciate that effort and value are correlated. Gartner’s findings aside, customers are willing to invest in implementation efforts…so long as the downstream value they derive ultimately justifies that investment. Customer’s tolerance is a function of both variables — effort and value. Conversely, if effort and value are NOT correlated, the result will be a painful or seemingly never-ending implementation period, customer frustration, and an inevitable drop in customer loyalty. Said another way, the concept of customer “effort” is certainly relative; and customers must believe that their effort will be rewarded AND that the effort should be minimized with an easy solution to implement, administer, and use. It strikes me that all of these elements might be loosely plotted on a graph like this.

3. Timing Matters (Part Deux): There is another timing-related dynamic that encompasses both of the points above. Just as kids want to play with their holiday gifts immediately upon opening them, virtually all software buyers want to take advantage of their technology purchases as soon as possible. In other words, they want to shorten the time to value capture once they’ve contracted to use a software solution (and this is a critical metric for SaaS providers to measure). Experienced customers know that the more concentrated effort they put in, the faster they’ll get value from the solution. Conversely, a leading reason for slow or unsuccessful implementations is a lack of prioritization and effort on behalf of customers…which leads to dissatisfaction and churn. In contrast to Gartner’s research, this is case where low customer effort certainly will not translate into long-term loyalty. Note: There is also admittedly a nagging chicken-and-egg dynamic at play here; and it is worth asking whether these slow implementations would get higher priority with a more motivated customer if we vendors made them demonstrably easier to execute(?).

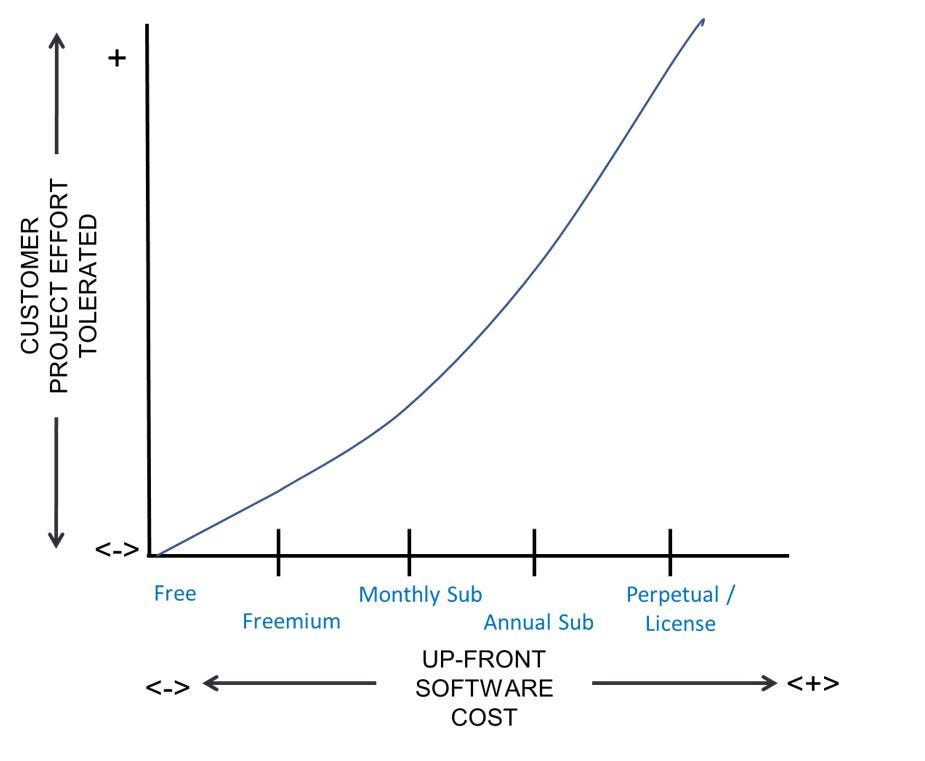

4. Economics Matter: There is an old saying that people don’t value the things they get for free. Without getting into a philosophical debate about total cost of ownership or open source software, it is safe to say that people’s commitment to any endeavor rises the more skin they have in the game. This is absolutely true when it comes to tolerance for project effort relating to software. Generally speaking, the less a business pays for software, the lower the willingness to invest effort implementing it. Free models command the lowest effort (virtually no skin in the game). Long-term license models (largely antiquated at this point) drive the highest. Many of us can remember a time when organizations paid huge sums up-front for a perpetual licenses…and then these pot-committed buyers would routinely have to spend years and fortunes implementing those same systems. Thankfully updated SaaS delivery and subscription models have put the onus on software providers to demonstrate value quickly and consistently, lest they risk churning the very customers they worked so hard to acquire. In any case, it strikes me as incomplete to say that low effort is unequivocally the highest determiner of customer loyalty. Rather, business model and up-front costs are other factors impacting customers’ tolerance for effort, with a related “effort curve” looking something like this:

In closing, the research on effortlessness brings an invaluable perspective to the rich topic of customer loyalty. But its application in the world of B2B software has its limits and should be applied with some caution. Specifically, while effortlessness may win the day in connection to downstream process work, delighting customers still seems to have a place in the world of up-front project work. Smart SaaS providers will benefit from understanding of customers’ journey with their solution and apply customer experience strategies accordingly. Similarly, it is important to understand a solution’s go-to-market strategy and packaging / pricing approach. Both will impact customers’ tolerance for investing effort, which should also inform the ideal customer experience. And, finally, the concept of “effortlessness” probably ought not be defined as NO effort. Instead, it is more relative in nature, where the work that needs to be done shouldn’t create unnecessary frustration. Said another way, effort is not the work itself; rather, it’s the infuriating customer feeling of “why does it have to be so hard?!” With that said, any and all customer work needs to be seamless and logical so they can derive value from their software purchases with as little effort as possible.

“The key to customer loyalty is an effortless customer service experience.” These seemingly innocuous words caught me flat-footed and punched me right in the nose. I’d been focused for so long on trying to delight customers that the concept of effortlessness caught me completely off-guard.

Since being captivated by the book “Ravings Fans” decades ago, I’ve been an unhesitating proponent for striving always to exceed customer expectations. But a friend and successful entrepreneur recently initiated a conversation that has brought such longstanding beliefs into question. His perspective is informed by two Gartner articles (here and here) with supporting research that challenges the actual business impact of delighting customers…and points to (low) effort as being the strongest driver to customer loyalty. These articles and concepts caught my eye and are forcing a reexamination of some of my long-held beliefs. Below are highlights from those articles along with some accompanying thoughts and considerations.

Based on research done by CEB (2013) with 97,000 customers, the data revealed four major findings:

The article goes on to offer interesting principles of low-effort service. But the truly mind-blowing part comes in a related article that encourages companies to create effortless customer service experiences (and discourages striving to create loyal customers through exceptional customer experiences). By offering statistics on the outcome of low-effort versus high-effort experiences, the following infographic makes this case in a truly compelling manner:

The takeaway from all of this, according to Gartner’s analysis, is that “customer effort is 40% more accurate at predicting customer loyalty as opposed to customer satisfaction.” Unsurprisingly, Gartner also introduces a metric, the Gartner Customer Effort Score, in order to measure the ease of customer interaction and resolution during a request for help.

To determine the score, simply calculate the percentage of customers that at least “somewhat agree” (those who give a 5 or above) that the company made it easy to resolve their issue. Seems straightforward enough in its implementation, analysis, and execution of steps to address the findings.

This all resonates with my anecdotal on-ground experience; and my takeaway from all of the above is that customer effort simply can’t be ignored. And, since the CES appears to be a metric that is easy enough to spin-up without any notable disruption to the overall client experience, there is every reason to give it a trial-run. Although I’m not quite ready to completely ditch more traditional CSAT metrics like NPS and WOMI, we certainly intend to test out CES and report-back the findings. After all, getting punched in the nose once is enough to create a desire to learn from the experience.